Maximize Your Savings: Earn Cash Back On Your Costco Visa Purchases

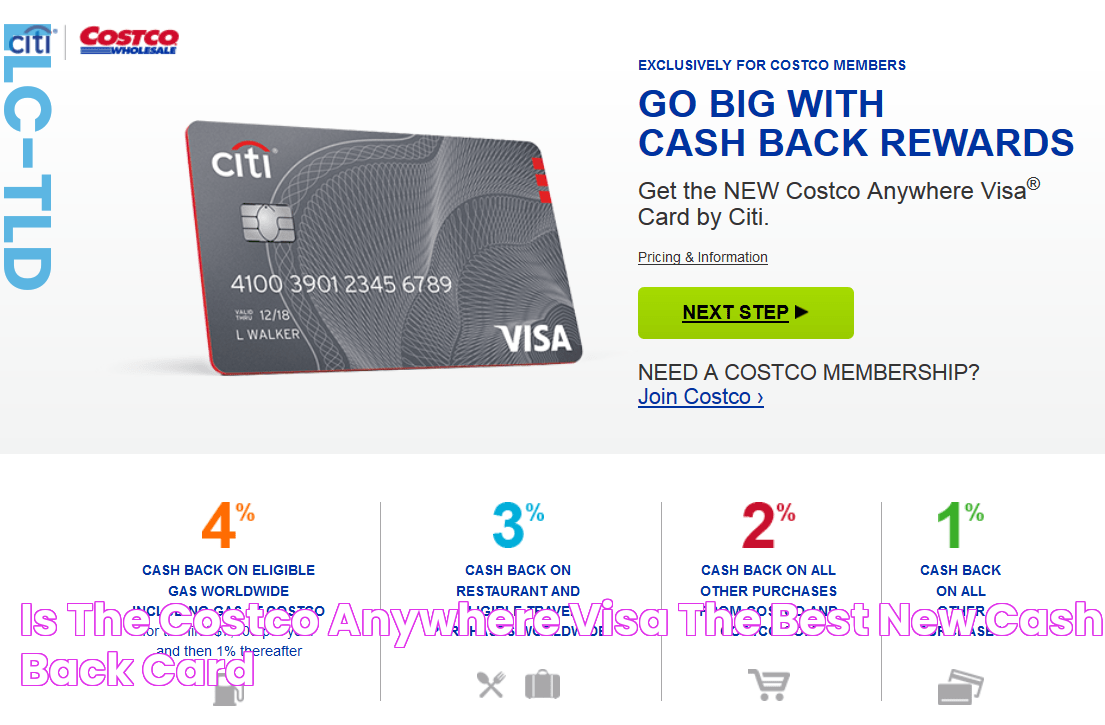

Cash back on Costco Visa refers to a rewards program offered by Costco in partnership with Visa. When using the Costco Anywhere Visa Card by Citi, cardholders earn cash back rewards on eligible purchases made at Costco warehouses, Costco.com, and on other purchases made anywhere Visa is accepted.

The cash back rewards earned can be redeemed as a statement credit, used to purchase items at Costco, or donated to charities. The rewards program offers varying cash back rates depending on the type of purchase and the cardholder's membership tier. Executive members receive higher cash back rewards compared to Gold Star members.

The Costco Anywhere Visa Card by Citi is a popular choice for Costco shoppers due to its competitive cash back rewards program, acceptance at various locations, and additional benefits such as extended warranty protection and travel benefits.

Read also:The Complete Guide To Angus Cloud And Mac Miller A Detailed Exploration

Cash Back on Costco Visa

The key aspects of cash back on Costco Visa are:

- Rewards program

- Costco Anywhere Visa Card

- Cash back rewards

- Executive members

- Gold Star members

- Statement credit

- Extended warranty

- Travel benefits

The Costco Anywhere Visa Card by Citi is a popular choice for Costco shoppers because it offers a generous cash back rewards program. Cardholders earn cash back on all purchases made at Costco, both in-store and online. They also earn cash back on purchases made anywhere Visa is accepted. The cash back rewards can be redeemed as a statement credit, used to purchase items at Costco, or donated to charities.

Executive members receive a higher cash back rate than Gold Star members. Executive members also receive other benefits, such as free shipping on Costco.com orders and access to exclusive member-only events. The Costco Anywhere Visa Card by Citi is a great way to save money on your Costco purchases. It is also a convenient way to earn rewards on your everyday spending.

1. Rewards program

A rewards program is a marketing strategy that offers customers incentives to make purchases. Rewards programs can come in many different forms, but they all share the common goal of encouraging customer loyalty. The cash back on Costco Visa is a type of rewards program that offers customers cash back on their purchases. This type of rewards program is popular because it is a simple and straightforward way for customers to save money.

The cash back on Costco Visa is a valuable component of the overall Costco membership experience. It provides customers with an incentive to shop at Costco and to use their Costco Visa card. The rewards program also helps to build customer loyalty and encourage repeat business.

The cash back on Costco Visa is a win-win for both Costco and its customers. Costco is able to attract and retain customers by offering a valuable rewards program. Customers are able to save money on their purchases and earn rewards for their loyalty.

Read also:Optimize Your Business With 9bids The Ultimate Digital Procurement Solution

2. Costco Anywhere Visa Card

The Costco Anywhere Visa Card is a credit card issued by Citibank that offers cash back rewards on purchases made at Costco and other locations. The card is a popular choice for Costco shoppers because it offers a generous cash back rewards program and other benefits, such as extended warranty protection and travel benefits.

- Rewards program

The Costco Anywhere Visa Card offers a cash back rewards program that allows cardholders to earn cash back on purchases made at Costco and other locations. The cash back rewards can be redeemed as a statement credit, used to purchase items at Costco, or donated to charities.

- Acceptance

The Costco Anywhere Visa Card is accepted at all Costco locations and at millions of other locations worldwide. This makes it a convenient card to use for everyday purchases.

- Benefits

The Costco Anywhere Visa Card offers a number of benefits, including extended warranty protection and travel benefits. The extended warranty protection doubles the manufacturer's warranty on most items purchased with the card. The travel benefits include trip cancellation/interruption insurance, lost luggage reimbursement, and emergency assistance.

- Fees

The Costco Anywhere Visa Card has an annual fee of $99. However, the card's rewards and benefits can often offset the annual fee.

The Costco Anywhere Visa Card is a great choice for Costco shoppers who want to earn cash back rewards and other benefits. The card's generous rewards program, wide acceptance, and valuable benefits make it a worthwhile investment.

3. Cash back rewards

Cash back rewards are a type of reward offered by credit cards and debit cards that allows cardholders to earn a percentage of their spending back in the form of cash. Cash back rewards can be redeemed in a variety of ways, such as statement credits, gift cards, or direct deposits into the cardholder's bank account.

- Reward rates

The cash back rewards rate is the percentage of spending that is earned back in the form of cash. Reward rates can vary depending on the card issuer, the card type, and the spending category. The cash back on Costco Visa offers a competitive cash back rewards rate, especially on purchases made at Costco warehouses and on Costco.com.

- Redemption options

Cash back rewards can be redeemed in a variety of ways, depending on the card issuer. The cash back on Costco Visa can be redeemed as a statement credit, used to purchase items at Costco, or donated to charities.

- Benefits

Cash back rewards can provide a number of benefits to cardholders. The cash back on Costco Visa can help cardholders save money on their everyday purchases, especially on purchases made at Costco.

- Fees

Some credit cards and debit cards charge an annual fee or other fees. The Costco Anywhere Visa Card by Citi has an annual fee of $99, but the card's rewards and benefits can often offset the annual fee.

Overall, cash back rewards can be a valuable benefit for credit card and debit card holders. The cash back on Costco Visa is a competitive cash back rewards program that offers a number of benefits to cardholders.

4. Executive members

In the context of "cash back on Costco Visa", "Executive members" refers to a tier of Costco membership that offers additional benefits and rewards, including a higher cash back rewards rate on Costco purchases.

Executive members pay an annual fee of $120, which is $60 more than the Gold Star membership fee. However, the increased cash back rewards rate can more than offset the annual fee, especially for frequent Costco shoppers.

For example, Executive members earn 2% cash back on all Costco purchases, while Gold Star members only earn 1% cash back. This means that Executive members earn twice as much cash back on their Costco purchases.

In addition to the higher cash back rewards rate, Executive members also receive other benefits, such as free shipping on Costco.com orders, access to exclusive member-only events, and extended warranty protection.

Overall, Executive membership is a valuable option for frequent Costco shoppers who want to earn more cash back on their purchases and take advantage of other exclusive benefits.

5. Gold Star members

Gold Star members are a tier of Costco membership that pay an annual fee of $60. In the context of "cash back on Costco Visa", Gold Star members earn 1% cash back on all Costco purchases made with the Costco Anywhere Visa Card by Citi.

While the cash back rewards rate for Gold Star members is lower than the 2% rate earned by Executive members, it is still a valuable benefit that can save shoppers money on their Costco purchases. For example, a Gold Star member who spends $5,000 per year at Costco will earn $50 in cash back rewards.

In addition to cash back rewards, Gold Star members also receive other benefits, such as access to exclusive member-only events, discounts on Costco services, and extended warranty protection. Overall, Gold Star membership is a good value for frequent Costco shoppers who want to save money on their purchases and take advantage of other exclusive benefits.

6. Statement credit

A statement credit is a credit applied to a credit card or debit card statement. Statement credits can be issued for a variety of reasons, including rewards, refunds, and adjustments.

- Rewards

One common reason for a statement credit is to reward customers for their loyalty. For example, many credit card companies offer statement credits to customers who spend a certain amount of money on their cards each year.

- Refunds

Statement credits can also be issued as refunds for purchases that were returned or canceled. For example, if you return an item to a store, the store may issue a statement credit to your credit card or debit card.

- Adjustments

Statement credits can also be issued to adjust for errors or mistakes. For example, if a credit card company charges you for a purchase that you did not make, the company may issue a statement credit to correct the error.

In the context of "cash back on Costco Visa", statement credits are a way for Costco to reward its customers for their purchases. When you use your Costco Anywhere Visa Card by Citi to make a purchase at Costco, you will earn cash back rewards. These rewards are then credited to your statement as a statement credit.

Statement credits are a valuable benefit of the Costco Anywhere Visa Card by Citi. They allow you to save money on your Costco purchases and can be used to purchase items at Costco, pay your Costco membership fee, or donate to charities.

7. Extended warranty

An extended warranty is a service contract that extends the manufacturer's warranty on a product. Extended warranties are typically offered by retailers or third-party companies. They can provide peace of mind and protection against unexpected repair costs.

- Cost and coverage

The cost of an extended warranty varies depending on the product and the length of the warranty. Extended warranties typically cover repairs and replacements due to defects in materials or workmanship. They may also cover accidental damage or other events that are not covered by the manufacturer's warranty.

- Benefits

Extended warranties can provide a number of benefits, including peace of mind, protection against unexpected repair costs, and extended coverage for repairs and replacements.

- Limitations

Extended warranties may have some limitations. For example, they may not cover all types of repairs or replacements. It is important to read the terms and conditions of an extended warranty carefully before purchasing it.

- Alternatives

There are a number of alternatives to extended warranties. For example, some credit cards offer extended warranty protection as a benefit. Additionally, some retailers offer their own extended warranty programs.

In the context of "cash back on Costco Visa", extended warranties are a valuable benefit that can provide peace of mind and protection against unexpected repair costs. The Costco Anywhere Visa Card by Citi offers extended warranty protection on most items purchased with the card. This benefit can save cardholders money on repairs and replacements, and it can also help to extend the life of their purchases.

Overall, extended warranties are a valuable consideration for anyone who wants to protect their purchases and save money on repairs and replacements.

8. Travel benefits

Travel benefits are a valuable part of the Costco Anywhere Visa Card by Citi. They can provide cardholders with peace of mind and protection when traveling, and they can also help cardholders save money on travel expenses.

- Trip cancellation/interruption insurance

Trip cancellation/interruption insurance can reimburse cardholders for prepaid travel expenses if their trip is canceled or interrupted for a covered reason. This can be a valuable benefit if cardholders have to cancel or interrupt their trip due to an unexpected event, such as a medical emergency or a natural disaster.

- Lost luggage reimbursement

Lost luggage reimbursement can reimburse cardholders for the cost of lost or damaged luggage. This can be a valuable benefit if cardholders' luggage is lost or damaged while they are traveling.

- Emergency assistance

Emergency assistance can provide cardholders with access to a variety of services, such as medical assistance, legal assistance, and financial assistance, in the event of an emergency while traveling. This can be a valuable benefit if cardholders need assistance while traveling in a foreign country or if they experience a medical emergency.

- Travel discounts

Travel discounts can provide cardholders with discounts on travel-related expenses, such as airfare, hotels, and rental cars. This can help cardholders save money on their travel expenses.

Overall, the travel benefits offered by the Costco Anywhere Visa Card by Citi are a valuable addition to the card's rewards program. They can provide cardholders with peace of mind and protection when traveling, and they can also help cardholders save money on travel expenses.

FAQs About Cash Back on Costco Visa

This FAQ section provides answers to common questions about cash back on Costco Visa. Whether you're a new or existing Costco member, this information can help you understand how to maximize your rewards and benefits.

Question 1: How does cash back on Costco Visa work?When you use your Costco Anywhere Visa Card by Citi to make purchases at Costco or anywhere Visa is accepted, you earn cash back rewards. The cash back rewards rate varies depending on your membership tier. Executive members earn 2% cash back on all Costco purchases, while Gold Star members earn 1% cash back. You can redeem your cash back rewards as a statement credit, use them to purchase items at Costco, or donate them to charities.

Question 2: Is there an annual fee for the Costco Anywhere Visa Card by Citi?Yes, there is an annual fee of $99 for the Costco Anywhere Visa Card by Citi. However, the card's generous rewards and benefits can often offset the annual fee.

Question 3: What are the benefits of being an Executive member?Executive members earn a higher cash back rewards rate on Costco purchases, as well as other benefits such as free shipping on Costco.com orders, access to exclusive member-only events, and extended warranty protection.

Question 4: How do I redeem my cash back rewards?You can redeem your cash back rewards as a statement credit, use them to purchase items at Costco, or donate them to charities. To redeem your rewards, simply log in to your Costco.com account and click on the "Cash Back Rewards" tab.

Question 5: Are there any restrictions on how I can use my cash back rewards?There are no restrictions on how you can use your cash back rewards. You can use them to purchase anything you want at Costco or anywhere Visa is accepted.

Question 6: How do I track my cash back rewards?You can track your cash back rewards by logging in to your Costco.com account and clicking on the "Cash Back Rewards" tab. You can also view your cash back rewards statement by logging in to your Citibank online account.

By understanding how cash back on Costco Visa works, you can maximize your rewards and benefits. With its generous rewards program, wide acceptance, and valuable benefits, the Costco Anywhere Visa Card by Citi is a great choice for Costco shoppers.

For more information about cash back on Costco Visa, please visit the Costco website or contact Citi customer service.

Tips on Maximizing Cash Back on Costco Visa

Costco's Anywhere Visa Card by Citi offers a generous cash back rewards program that can save you money on your everyday purchases. Here are some tips on how to maximize your cash back earnings:

Tip 1: Choose the right card for your spending habits.

Costco offers two Visa cards: the Gold Star card and the Executive card. The Gold Star card has an annual fee of $60, while the Executive card has an annual fee of $120. However, the Executive card offers a higher cash back rewards rate of 2% on all Costco purchases, compared to 1% for the Gold Star card. If you spend a lot of money at Costco, the Executive card may be a better value for you.

Tip 2: Use your Costco Visa card for all of your Costco purchases.

This may seem obvious, but it's worth repeating: the more you use your Costco Visa card, the more cash back you will earn. Make sure to use your card for all of your Costco purchases, both in-store and online.

Tip 3: Take advantage of Costco's quarterly bonus categories.

Each quarter, Costco offers bonus cash back rewards on certain categories of purchases. For example, you may earn 4% cash back on gas purchases during the first quarter of the year. Be sure to check the Costco website or your Costco Visa statement to see which categories are eligible for bonus cash back each quarter.

Tip 4: Redeem your cash back rewards wisely.

You can redeem your cash back rewards as a statement credit, use them to purchase items at Costco, or donate them to charities. If you choose to redeem your rewards as a statement credit, you can use the credit to pay down your Costco Visa balance or withdraw the funds to your bank account.

Tip 5: Track your cash back rewards.

You can track your cash back rewards by logging in to your Costco.com account or by viewing your Costco Visa statement. This will help you stay on top of your rewards and make sure you're maximizing your earnings.

By following these tips, you can maximize your cash back earnings on your Costco Visa and save money on your everyday purchases.

Conclusion

Cash back on Costco Visa is a valuable rewards program that can save you money on your everyday purchases. The Costco Anywhere Visa Card by Citi offers a generous cash back rewards rate, as well as other benefits such as extended warranty protection and travel benefits. By following the tips in this article, you can maximize your cash back earnings and save even more money.

If you are a Costco shopper, the Costco Anywhere Visa Card by Citi is a must-have. With its generous rewards program and valuable benefits, it is the best way to save money on your Costco purchases.

Rent Your Double Fun Pontoon Today!

Unveiling The Safety Of Aptive Pest Control

The Big Kiss: When Luke And Lorelai Seal Their Love