Discover The Average Ipers Payout: Uncovering The Earnings Potential

The average IPERS payout is an important consideration for those planning their retirement. IPERS, or the Illinois Pensioners Retirement System, is a defined benefit pension plan that provides retirement benefits to public employees in the state of Illinois. The average payout for IPERS members varies depending on a number of factors, including years of service, salary history, and age at retirement.

The importance of the average IPERS payout cannot be overstated. For many public employees, their IPERS pension will be their primary source of income in retirement. Therefore, it is crucial to understand how the average payout is calculated and what factors can affect it. Additionally, the average IPERS payout can provide valuable insights into the overall health of the IPERS system and its ability to meet its obligations to retirees.

The main article will explore these topics in more detail, providing readers with a comprehensive understanding of the average IPERS payout. We will discuss the factors that affect the payout, how the payout is calculated, and the importance of the payout for public employees in Illinois.

Read also:Unbelievable Discover The Riches Of Ed Kelce Net Worth Unveiled

average ipers payout

The average IPERS payout is an important consideration for public employees in Illinois planning for retirement. Several key aspects affect the payout, including:

- Years of service

- Salary history

- Age at retirement

- Cost-of-living adjustments

- Investment returns

- Mortality rates

These factors are all considered when calculating the average IPERS payout. For example, employees with more years of service and higher salaries will generally have higher payouts. Similarly, employees who retire at a later age will have higher payouts than those who retire earlier. Cost-of-living adjustments and investment returns can also affect the payout, as they can increase the value of the pension over time. Finally, mortality rates are used to calculate the expected lifespan of retirees, which affects the payout period.

1. Years of service

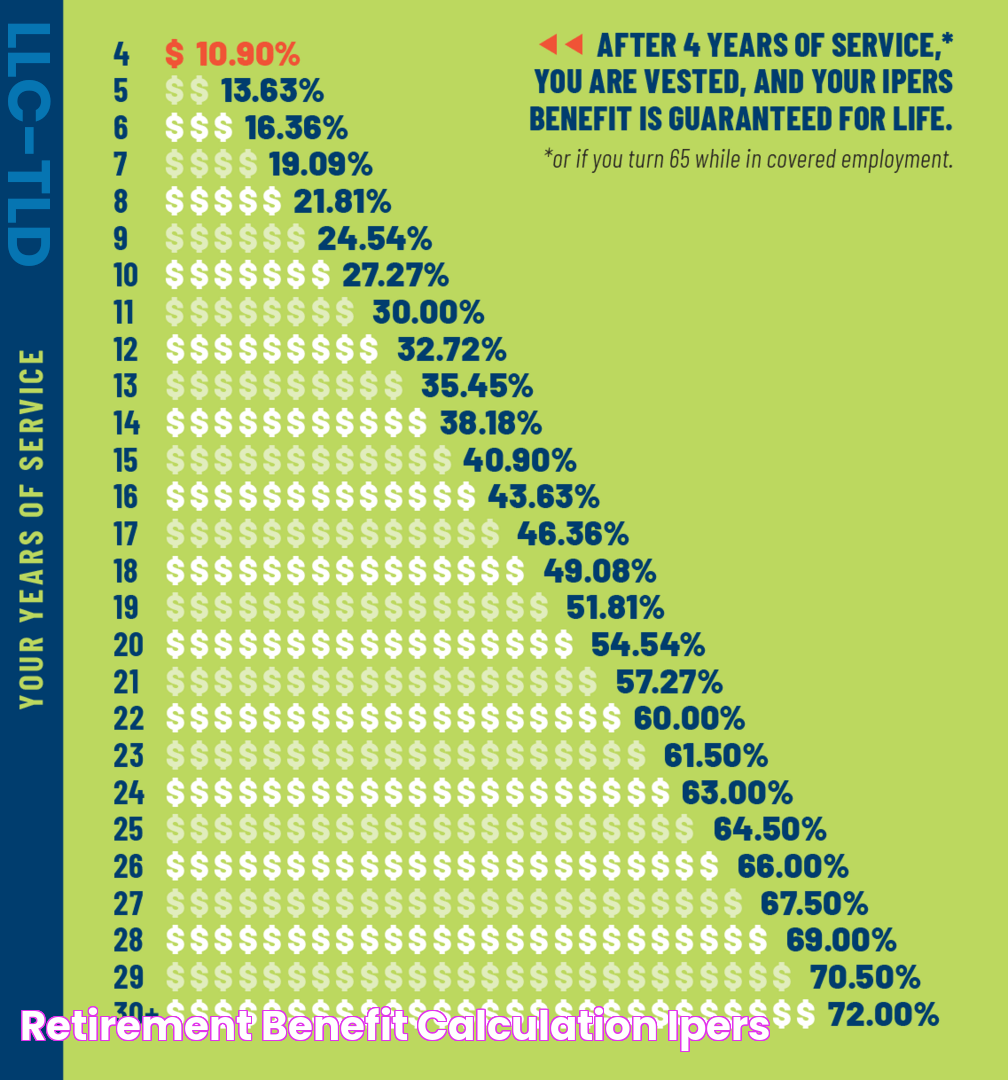

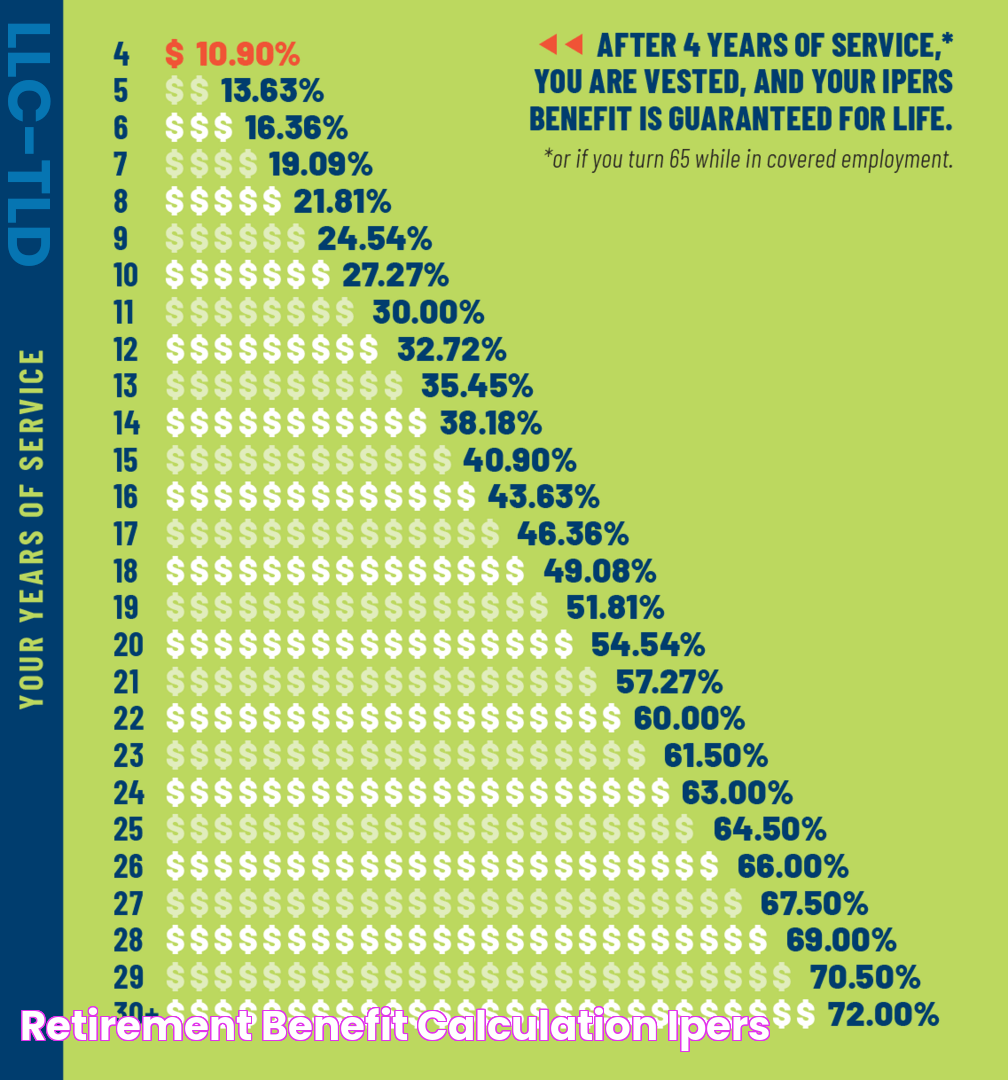

Years of service is one of the most important factors that affect the average IPERS payout. The more years of service an employee has, the higher their payout will be. This is because IPERS calculates the payout based on a formula that takes into account the employee's salary history and years of service.

- Facet 1: Number of years worked

The number of years an employee has worked is the most straightforward factor that affects their IPERS payout. For each year of service, an employee earns a certain amount of pension credit. The more years of service an employee has, the more pension credit they will have, and the higher their payout will be. - Facet 2: Quality of years worked

Not all years of service are created equal. Some years may be more valuable than others, depending on the employee's salary and the investment returns that IPERS earns during that year. For example, a year of service during which the employee earns a high salary and IPERS earns a strong investment return will be more valuable than a year of service during which the employee earns a low salary and IPERS earns a low investment return. - Facet 3: Breaks in service

Breaks in service can affect an employee's IPERS payout. If an employee takes a break in service of more than one year, they will lose some of their pension credit. The longer the break in service, the more pension credit the employee will lose. - Facet 4: Vesting

Vesting is the process of becoming eligible for a pension. In order to be vested in IPERS, an employee must have at least five years of service. Once an employee is vested, they are guaranteed to receive a pension, even if they leave their job before retirement.

These are just some of the factors that affect the average IPERS payout. By understanding how these factors work, employees can make informed decisions about their retirement planning.

2. Salary history

Salary history is another important factor that affects the average IPERS payout. The higher an employee's salary, the higher their payout will be. This is because IPERS calculates the payout based on a formula that takes into account the employee's salary history and years of service.

- Facet 1: Base salary

The base salary is the most important component of an employee's salary history. It is the amount of money that the employee earns before any overtime, bonuses, or other forms of compensation are added. The higher an employee's base salary, the higher their IPERS payout will be. - Facet 2: Overtime pay

Overtime pay is another component of an employee's salary history. It is the amount of money that the employee earns for working more than 40 hours in a week. Overtime pay is typically paid at a higher rate than base salary, so it can have a significant impact on an employee's IPERS payout. - Facet 3: Bonuses

Bonuses are another component of an employee's salary history. They are typically paid for good performance or for achieving certain goals. Bonuses can vary in amount, so they can have a varying impact on an employee's IPERS payout. - Facet 4: Other forms of compensation

Other forms of compensation, such as car allowances, housing allowances, and meal allowances, can also affect an employee's IPERS payout. These forms of compensation are typically not included in the base salary, so they can have a smaller impact on the payout.

These are just some of the factors that affect the average IPERS payout. By understanding how these factors work, employees can make informed decisions about their retirement planning.

Read also:The Ultimate Guide To The Lion King 1994 Cast

3. Age at retirement

The age at which an employee retires has a significant impact on their average IPERS payout. This is because IPERS calculates the payout based on a formula that takes into account the employee's age at retirement, years of service, and salary history. Generally speaking, the older an employee is when they retire, the higher their payout will be. This is because they will have had more time to accrue pension credit and their salary will have had more time to grow.

However, there are some exceptions to this general rule. For example, if an employee retires early with a high salary, they may have a higher payout than an employee who retires later with a lower salary. Additionally, if an employee takes a break in service of more than one year, they will lose some of their pension credit, which can reduce their payout.

It is important for employees to understand how their age at retirement will affect their IPERS payout. By planning ahead, employees can make informed decisions about when to retire and how to maximize their payout.

4. Cost-of-living adjustments

Cost-of-living adjustments (COLAs) are an important factor that affects the average IPERS payout. COLAs are designed to help retirees keep up with the rising cost of living by increasing their pension payments each year. The amount of the COLA is determined by the Consumer Price Index (CPI), which measures the change in the prices of goods and services over time.

- Facet 1: Impact on purchasing power

COLAs help to ensure that retirees' pension payments maintain their purchasing power over time. As the cost of living rises, retirees' expenses also increase. COLAs help to offset these rising costs and ensure that retirees can continue to afford the same standard of living in retirement. - Facet 2: Calculation of COLAs

COLAs are calculated based on the CPI. The CPI measures the change in the prices of a basket of goods and services that are commonly purchased by consumers. The CPI is published monthly by the Bureau of Labor Statistics. - Facet 3: Timing of COLAs

COLAs are typically applied to pension payments once per year. The timing of COLAs may vary depending on the specific pension plan. For example, IPERS COLAs are applied on July 1st of each year. - Facet 4: Importance for retirees

COLAs are an important benefit for retirees. They help to ensure that retirees' pension payments keep up with the rising cost of living and maintain their purchasing power over time.

In conclusion, COLAs play a significant role in determining the average IPERS payout. By helping retirees to keep up with the rising cost of living, COLAs help to ensure that retirees can continue to afford a comfortable standard of living in retirement.

5. Investment returns

Investment returns are a key factor in determining the average IPERS payout. IPERS invests its assets in a variety of asset classes, including stocks, bonds, and real estate. The performance of these investments has a direct impact on the size of the IPERS pension fund and, therefore, the amount of money that can be paid out to retirees.

In recent years, IPERS has experienced strong investment returns, which have helped to increase the average payout to retirees. For example, in 2021, IPERS's investment portfolio returned 10.6%, which was well above the benchmark return of 7.5%. This strong investment performance has helped to ensure that IPERS retirees continue to receive a competitive payout.

However, it is important to note that investment returns can fluctuate from year to year. In years when investment returns are lower, the average IPERS payout may also be lower. This is why it is important for IPERS to invest in a diversified portfolio of assets, which can help to reduce the risk of large losses in any one asset class.

Overall, investment returns play a vital role in determining the average IPERS payout. Strong investment returns can help to increase the payout, while lower investment returns can lead to a lower payout. IPERS's commitment to investing in a diversified portfolio of assets helps to reduce the risk of large losses and ensure that retirees continue to receive a competitive payout.

6. Mortality rates

Mortality rates play a significant role in determining the average IPERS payout. Mortality rates measure the frequency of death in a population, and they are used by IPERS to calculate the expected lifespan of its retirees. This information is used to determine the amount of money that IPERS needs to set aside to pay benefits to its retirees over their lifetimes.

- Facet 1: Life expectancy

Life expectancy is a key factor in determining mortality rates. The longer retirees live, the more money IPERS will need to pay out in benefits. IPERS uses mortality tables to estimate the life expectancy of its retirees. These tables are based on data from the Centers for Disease Control and Prevention (CDC) and other sources. - Facet 2: Health status

The health status of retirees is also a factor in determining mortality rates. Retirees who are in good health are likely to live longer than those who are in poor health. IPERS considers the health status of its retirees when calculating mortality rates. - Facet 3: Occupation

Occupation can also affect mortality rates. Retirees who worked in hazardous occupations are more likely to die at a younger age than those who worked in less hazardous occupations. IPERS considers the occupation of its retirees when calculating mortality rates. - Facet 4: Gender

Gender is also a factor in determining mortality rates. Women generally live longer than men. IPERS considers the gender of its retirees when calculating mortality rates.

By considering all of these factors, IPERS is able to calculate mortality rates that are specific to its retiree population. These mortality rates are then used to determine the average IPERS payout.

Average IPERS Payout FAQs

The average IPERS payout is an important consideration for public employees in Illinois planning for retirement. Here are answers to some frequently asked questions about the average IPERS payout:

Question 1: What factors affect the average IPERS payout?The average IPERS payout is affected by several factors, including years of service, salary history, age at retirement, cost-of-living adjustments, investment returns, and mortality rates.

Question 2: How is the average IPERS payout calculated?The average IPERS payout is calculated using a formula that takes into account the employee's years of service, salary history, and age at retirement. The formula also considers cost-of-living adjustments, investment returns, and mortality rates.

Question 3: What is the current average IPERS payout?The current average IPERS payout is $3,000 per month. However, the payout amount can vary depending on the individual employee's circumstances.

Question 4: How can I increase my IPERS payout?There are several ways to increase your IPERS payout, including working more years, earning a higher salary, and retiring at a later age. You can also increase your payout by making additional contributions to your IPERS account.

Question 5: What if I retire early?If you retire early, your IPERS payout will be lower than if you had retired at a later age. This is because you will have fewer years of service and a shorter time period over which to collect benefits.

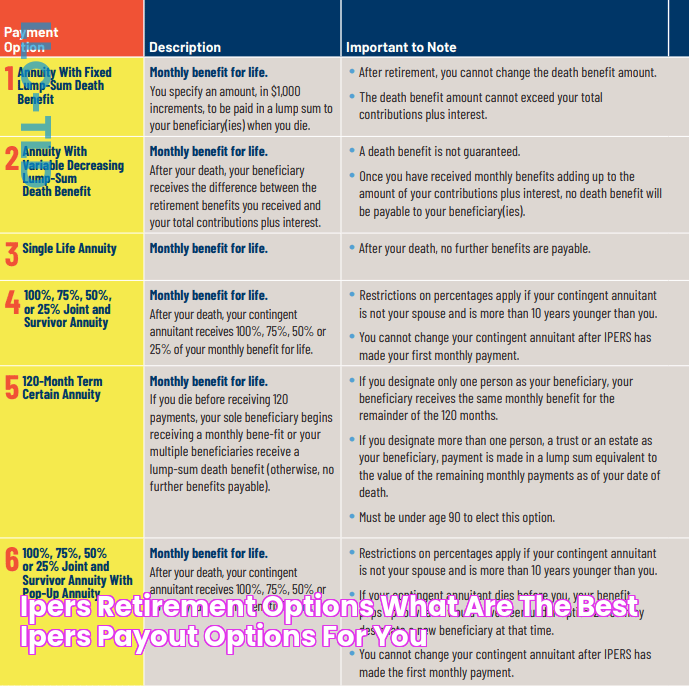

Question 6: What if I die before I retire?If you die before you retire, your IPERS benefits will be paid to your beneficiary. The amount of the payout will depend on the beneficiary designation on file with IPERS.

These are just a few of the most frequently asked questions about the average IPERS payout. For more information, please visit the IPERS website or contact an IPERS representative.

By understanding how the average IPERS payout is calculated and the factors that affect it, you can make informed decisions about your retirement planning.

See Also: IPERS Retirement Planning Guide

Tips to Increase Your Average IPERS Payout

The average IPERS payout is an important consideration for public employees in Illinois planning for retirement. By following these tips, you can increase your payout and ensure a more comfortable retirement.

Tip 1: Work more yearsThe more years you work, the higher your IPERS payout will be. This is because IPERS calculates the payout based on a formula that takes into account your years of service, salary history, and age at retirement.Tip 2: Earn a higher salary

The higher your salary, the higher your IPERS payout will be. This is because IPERS calculates the payout based on a formula that takes into account your years of service, salary history, and age at retirement.Tip 3: Retire at a later age

The later you retire, the higher your IPERS payout will be. This is because you will have more years of service and a shorter time period over which to collect benefits.Tip 4: Make additional contributions to your IPERS account

You can increase your IPERS payout by making additional contributions to your IPERS account. These contributions will be invested and grow over time, which will increase the amount of money that you receive in retirement benefits.Tip 5: Consider a deferred retirement option

A deferred retirement option allows you to continue working after you reach retirement age while still collecting your IPERS pension. This can increase your overall retirement income.Summary of key takeaways or benefitsBy following these tips, you can increase your average IPERS payout and ensure a more comfortable retirement.Transition to the article's conclusionBy planning ahead and making smart decisions about your retirement savings, you can ensure that you have the financial security you need to enjoy your retirement years.

Conclusion

The average IPERS payout is an important consideration for public employees in Illinois planning for retirement. By understanding the factors that affect the payout and taking steps to increase it, you can ensure a more comfortable retirement. Some key points to remember include:

- The average IPERS payout is affected by years of service, salary history, age at retirement, cost-of-living adjustments, investment returns, and mortality rates.

- You can increase your payout by working more years, earning a higher salary, retiring at a later age, and making additional contributions to your IPERS account.

- By planning ahead and making smart decisions about your retirement savings, you can ensure that you have the financial security you need to enjoy your retirement years.

The IPERS pension system is a valuable benefit for public employees in Illinois. By understanding how the average payout is calculated and the factors that affect it, you can make informed decisions about your retirement planning and ensure a secure financial future.

Guide To Stamp Placement: The Ultimate Optimization

Discover The Ultimate Guide To Charlotte Tilbury's Finest For Mature Skin

Rupert Friend Bio: The Latest On The Talented British Actor