Discover The Ultimate Guide To Chase Card Services

Chase Card Services is a comprehensive suite of financial products and services offered by Chase, a leading financial institution in the United States. These services are designed to meet the diverse financial needs of individuals and businesses, providing convenience, flexibility, and rewards.

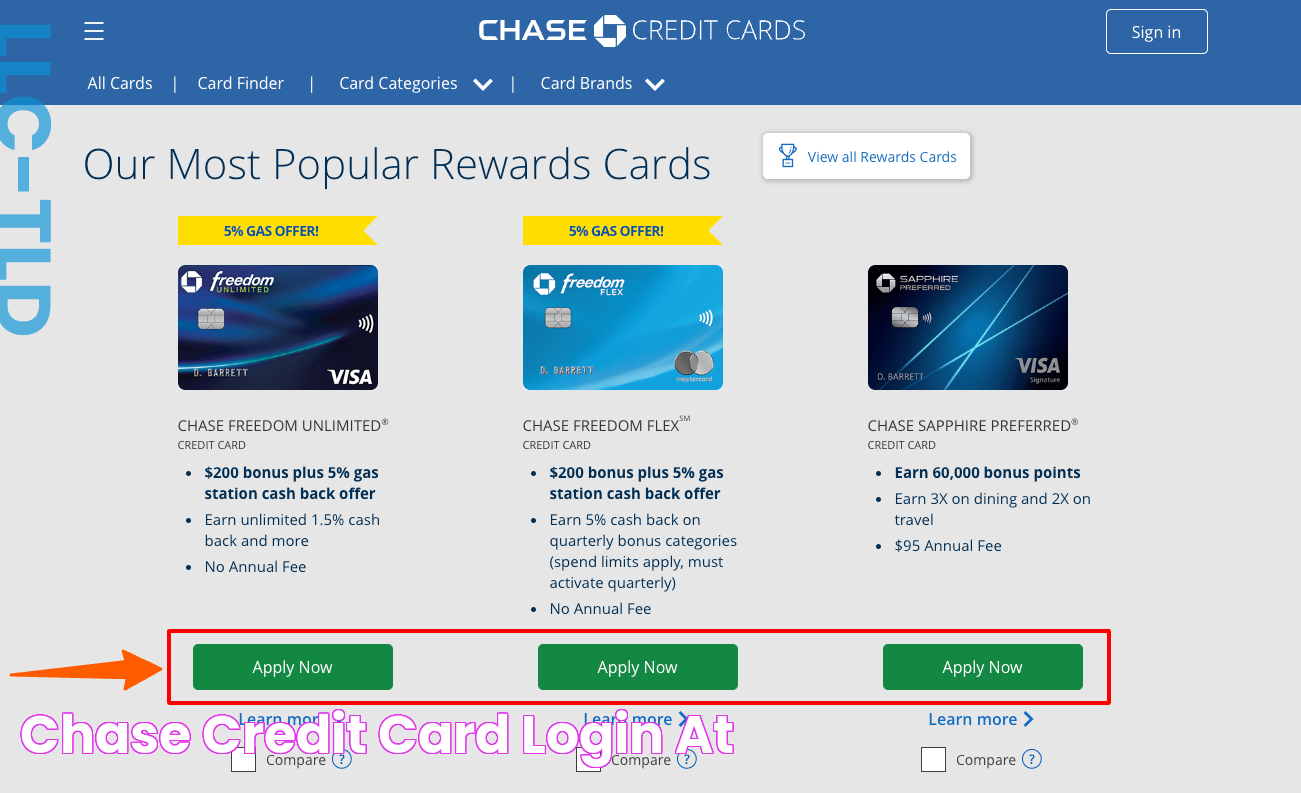

Chase Card Services include a wide range of credit cards, debit cards, and prepaid cards. These cards offer a variety of benefits, including rewards points, cash back, travel miles, and purchase protection. Chase also provides a variety of online and mobile banking tools that allow customers to manage their accounts and make payments easily and securely.

Chase Card Services has a long history of providing innovative and customer-centric financial products and services. The company is committed to delivering exceptional customer service and building lasting relationships with its customers.

Read also:Discover The Best Metlife Insurance Solutions Tailored To Your Needs

Chase Card Services

Chase Card Services offers a comprehensive suite of financial products and services designed to meet the diverse financial needs of individuals and businesses. These services include a wide range of credit cards, debit cards, and prepaid cards, as well as a variety of online and mobile banking tools.

- Convenience: Chase Card Services offers a variety of convenient features, such as online and mobile banking, that allow customers to manage their accounts and make payments easily and securely.

- Flexibility: Chase Card Services offers a variety of card options, including credit cards, debit cards, and prepaid cards, to meet the diverse financial needs of customers.

- Rewards: Chase Card Services offers a variety of rewards programs that allow customers to earn points, miles, or cash back on their purchases.

- Security: Chase Card Services offers a variety of security features to protect customers from fraud and unauthorized use.

- Customer service: Chase Card Services offers 24/7 customer service to help customers with any questions or issues they may have.

- Innovation: Chase Card Services is constantly innovating and developing new products and services to meet the changing needs of customers.

- Value: Chase Card Services offers a variety of valuable features and benefits that can help customers save money and manage their finances more effectively.

- Trust: Chase Card Services is a trusted financial institution with a long history of providing quality products and services to customers.

These key aspects make Chase Card Services a valuable financial partner for individuals and businesses. Chase is committed to delivering exceptional customer service and building lasting relationships with its customers.

1. Convenience

Convenience is a key aspect of Chase Card Services. Chase offers a variety of convenient features, such as online and mobile banking, that allow customers to manage their accounts and make payments easily and securely. This convenience is essential for customers who want to manage their finances on the go or who simply want to save time and hassle.

- Online banking: Chase's online banking platform allows customers to view their account balances, transfer funds, pay bills, and more. Customers can also set up automatic payments and receive account alerts.

- Mobile banking: Chase's mobile banking app allows customers to do everything they can do on the online banking platform, plus they can deposit checks, find ATMs, and more. The mobile banking app is available for both iOS and Android devices.

- Contactless payments: Chase cards support contactless payments, which allow customers to pay for purchases by simply tapping their card on a payment terminal. This is a convenient and secure way to pay for purchases.

- Cardless ATM withdrawals: Chase customers can withdraw cash from ATMs without using their card. This is a convenient option for customers who have lost their card or who simply don't want to carry it with them.

These are just a few of the convenient features that Chase Card Services offers. Chase is committed to providing customers with the tools and resources they need to manage their finances easily and securely.

2. Flexibility

Flexibility is a key component of Chase Card Services. Chase offers a variety of card options, including credit cards, debit cards, and prepaid cards, to meet the diverse financial needs of customers. This flexibility is essential for customers who want to have a variety of payment options available to them.

For example, customers who want to earn rewards on their purchases may choose a Chase credit card. Customers who need a convenient way to access their cash may choose a Chase debit card. And customers who want to manage their spending more carefully may choose a Chase prepaid card.

Read also:Discover The Extraordinary World Of Erome Makay

The flexibility of Chase Card Services allows customers to choose the card that best meets their individual needs. This flexibility is one of the reasons why Chase Card Services is a popular choice for consumers.

Here are some of the benefits of the flexibility of Chase Card Services:

- Customers can choose the card that best meets their individual needs.

- Customers can have a variety of payment options available to them.

- Customers can manage their spending more carefully.

If you are looking for a flexible and convenient way to manage your finances, Chase Card Services is a great option.

3. Rewards

In today's competitive financial landscape, rewards programs have become an essential feature for credit card companies to attract and retain customers. Chase Card Services has recognized this trend and offers a variety of rewards programs that cater to the diverse needs of its customers.

- Earn points on every purchase: Chase credit cards allow customers to earn points on every purchase they make, regardless of the amount. These points can then be redeemed for a variety of rewards, such as travel, gift cards, or cash back.

- Bonus categories: Many Chase credit cards offer bonus categories, which allow customers to earn more points on certain types of purchases, such as groceries, gas, or dining out. This can be a great way to maximize the value of your rewards.

- Travel rewards: Chase offers a number of credit cards that are specifically designed for travel rewards. These cards allow customers to earn points that can be redeemed for flights, hotels, and other travel expenses.

- Cash back rewards: Chase also offers a number of credit cards that offer cash back rewards. These cards allow customers to earn cash back on every purchase they make, which can be a great way to save money.

The rewards programs offered by Chase Card Services are a valuable perk for customers. These programs can help customers save money, travel more, and get more value out of their everyday spending.

4. Security

In today's digital age, security is more important than ever before. Chase Card Services recognizes this and offers a variety of security features to protect its customers from fraud and unauthorized use.

- Encryption: Chase uses encryption to protect customer data, both online and offline. This means that customer information is scrambled so that it cannot be read by unauthorized users.

- Fraud monitoring: Chase's fraud monitoring system is designed to detect and prevent fraudulent activity. This system uses a variety of algorithms to identify suspicious transactions and flag them for review.

- Chip technology: Chase cards are equipped with chip technology, which makes them more difficult to counterfeit. Chip technology also provides additional security for online transactions.

- Zero liability protection: Chase offers zero liability protection to its customers, which means that customers are not responsible for unauthorized transactions made with their card.

These are just a few of the security features that Chase Card Services offers. Chase is committed to providing its customers with the highest level of security.

5. Customer service

Excellent customer service is a cornerstone of Chase Card Services, contributing significantly to its overall value proposition and enhancing the customer experience.

- Availability and Accessibility

Chase Card Services' 24/7 customer service ensures that customers can receive assistance whenever they need it, fostering a sense of and reliability. Customers can connect with knowledgeable representatives through multiple channels, including phone, online chat, and secure messaging, providing flexibility and convenience.

- Personalized Support

Chase Card Services representatives are trained to provide personalized and tailored support, understanding that each customer's financial needs and concerns are unique. They take the time to listen to customers' queries or issues and work collaboratively to find the best solutions.

- Issue Resolution

The 24/7 customer service offered by Chase Card Services empowers customers to promptly address any questions or issues related to their accounts, transactions, or card usage. This timely assistance minimizes inconvenience and helps customers maintain control over their finances.

- Building Customer Relationships

Beyond resolving immediate concerns, Chase Card Services' customer service team is dedicated to building lasting relationships with customers. They go the extra mile to ensure satisfaction and foster trust, contributing to the overall positive perception of the brand.

In summary, the 24/7 customer service provided by Chase Card Services is a key differentiator, providing customers with peace of mind, personalized support, efficient issue resolution, and the foundation for strong customer relationships.

6. Innovation

Chase Card Services understands that the financial landscape is constantly evolving, and customer needs are continuously changing. To stay ahead of the curve, Chase Card Services is committed to innovation, consistently developing and introducing new products and services that cater to the evolving needs of its customers.

- Digital payment options

Chase Card Services has been at the forefront of digital payment innovation, introducing features such as mobile payments, contactless payments, and peer-to-peer payment services. These innovations have made it easier and more convenient for customers to make payments and manage their finances.

- Rewards and loyalty programs

Chase Card Services offers a variety of rewards and loyalty programs that allow customers to earn points, miles, and cash back on their purchases. These programs incentivize customers to use their Chase cards and provide them with valuable rewards for their loyalty.

- Security and fraud protection

Chase Card Services prioritizes the security of its customers' financial information and transactions. The company invests heavily in fraud detection and prevention technologies to protect customers from fraud and unauthorized use of their cards.

- Customer service and support

Chase Card Services is committed to providing excellent customer service and support. The company offers 24/7 customer service through multiple channels, including phone, online chat, and secure messaging. Chase Card Services also provides extensive online resources and FAQs to help customers with any questions or issues they may have.

The innovation of Chase Card Services has resulted in a suite of products and services that meet the diverse needs of its customers. Chase Card Services is well-positioned to continue innovating and leading the industry in the years to come.

7. Value

The value proposition of Chase Card Services lies in the suite of valuable features and benefits it offers to its customers. These features and benefits are designed to help customers save money, manage their finances more effectively, and enjoy a range of rewards and perks.

One of the key value drivers of Chase Card Services is its rewards programs. Chase offers a variety of credit cards that allow customers to earn points, miles, or cash back on their purchases. These rewards can be redeemed for a variety of valuable items, such as travel, gift cards, or cash back. This can help customers save money on their everyday spending and enjoy additional perks.

Another important value proposition of Chase Card Services is its focus on security and fraud protection. Chase uses a variety of security features to protect its customers' financial information and transactions. These features include encryption, fraud monitoring, and zero liability protection. This gives customers peace of mind knowing that their financial information is safe and secure. In addition, Chase Card Services offers a range of other valuable features and benefits, such as:- Convenient online and mobile banking

- Contactless payments

- Cardless ATM withdrawals

- 24/7 customer service

These features and benefits make Chase Card Services a valuable choice for consumers who are looking for a convenient, secure, and rewarding way to manage their finances.

In conclusion, the value of Chase Card Services lies in the combination of its valuable features, benefits, and rewards programs. These offerings help customers save money, manage their finances more effectively, and enjoy a range of perks and rewards.

8. Trust

Trust is a cornerstone of Chase Card Services, built upon a solid foundation of reliability, security, and customer-centricity. The company's longevity and consistent track record have established it as a trusted partner for financial management.

- Established Presence:

Chase has been a prominent player in the financial industry for over a century, serving generations of customers. Its enduring presence signifies stability and reliability, fostering trust among its clientele.

- Commitment to Quality:

Chase Card Services prioritizes delivering high-quality products and services. The company invests in innovative technology, robust security measures, and responsive customer support to ensure a seamless and satisfying experience for its cardholders.

- Customer-Centric Approach:

Chase Card Services places great emphasis on understanding and meeting the evolving needs of its customers. Personalized offerings, tailored rewards programs, and accessible support channels demonstrate the company's commitment to customer satisfaction.

- Industry Recognition:

Chase Card Services has consistently received accolades and recognition from industry experts and consumer advocacy organizations. These acknowledgements serve as external validation of the company's trustworthiness and the value it provides to its customers.

The trust that Chase Card Services has cultivated among its customers is a testament to the company's unwavering commitment to excellence. This trust serves as a competitive advantage, enabling Chase to attract and retain a loyal customer base.

Frequently Asked Questions (FAQs) about Chase Card Services

This section provides answers to commonly asked questions about Chase Card Services. These FAQs are designed to help you understand the benefits, features, and usage of Chase credit cards, debit cards, and prepaid cards.

Question 1: What are the benefits of using Chase Card Services?Chase Card Services offer a wide range of benefits, including rewards programs, purchase protection, travel benefits, and more. You can earn points, miles, or cash back on your purchases, and redeem them for travel, gift cards, or other rewards. Chase cards also offer protection against unauthorized purchases, and some cards come with travel benefits such as trip cancellation insurance and baggage delay reimbursement.

Question 2: What are the different types of Chase credit cards? Chase offers a variety of credit cards to meet different needs and lifestyles. Some of the most popular types of Chase credit cards include:

- Rewards credit cards: These cards allow you to earn points, miles, or cash back on your purchases.

- Travel credit cards: These cards offer travel-related benefits, such as bonus points on travel purchases, airport lounge access, and trip cancellation insurance.

- Balance transfer credit cards: These cards allow you to transfer your balances from other credit cards at a lower interest rate.

- Business credit cards: These cards are designed for business owners and offer features such as rewards on business purchases and employee cards.

You can apply for a Chase credit card online, by phone, or in person at a Chase branch. To apply online, visit the Chase website and click on the "Credit Cards" tab. You will need to provide your personal information, financial information, and employment information. Chase will review your application and notify you of their decision within a few days.

Question 4: What is the difference between a credit card and a debit card?A credit card is a type of loan that allows you to borrow money to make purchases. You are billed for your purchases at the end of each month, and you have the option to pay off your balance in full or make minimum payments. A debit card is linked to your checking account, and when you make a purchase, the money is deducted from your account immediately. Debit cards do not offer the same benefits as credit cards, such as rewards programs and purchase protection.

Question 5: What is a prepaid card?A prepaid card is a type of card that is loaded with a specific amount of money. You can use a prepaid card to make purchases anywhere that accepts credit cards. Prepaid cards are a good option for people who do not qualify for a credit card or who want to control their spending.

Question 6: How do I manage my Chase Card Services account?You can manage your Chase Card Services account online, by phone, or in person at a Chase branch. To manage your account online, visit the Chase website and log in to your account. You can view your account balance, make payments, redeem rewards, and more. You can also manage your account by calling the number on the back of your card or by visiting a Chase branch.

Summary: Chase Card Services offer a wide range of benefits and features to meet your financial needs. By understanding the different types of cards and how to use them, you can maximize the value of your Chase Card Services account.

Next: Explore other articles to learn more about Chase Card Services and other financial topics.

Tips

Chase Card Services offers a variety of credit cards, debit cards, and prepaid cards to meet your financial needs. Here are some tips to help you get the most out of your Chase Card Services account:

Tip 1: Choose the right card for your needs

Chase offers a variety of credit cards, debit cards, and prepaid cards, each with its own unique benefits and features. Consider your spending habits and financial goals when choosing a card. For example, if you travel frequently, you may want to choose a credit card that offers travel rewards. If you are trying to build your credit, you may want to choose a secured credit card.

Tip 2: Use your card responsibly

It is important to use your Chase card responsibly to avoid debt and damage to your credit score. Pay your bills on time and in full each month, and only charge what you can afford to pay back. If you carry a balance on your credit card, be sure to make at least the minimum payment each month.

Tip 3: Take advantage of rewards and benefits

Many Chase cards offer rewards and benefits, such as cash back, points, and miles. Be sure to take advantage of these rewards and benefits to save money and get more value from your card. For example, you can redeem your rewards for travel, gift cards, or cash back.

Tip 4: Manage your account online

You can manage your Chase Card Services account online, by phone, or in person at a Chase branch. Managing your account online is a convenient way to view your balance, make payments, redeem rewards, and more. You can also set up automatic payments to avoid late fees.

Tip 5: Keep your information secure

It is important to keep your Chase Card Services information secure to avoid fraud and identity theft. Never share your card number or PIN with anyone. Be sure to report lost or stolen cards immediately.

Summary:

By following these tips, you can get the most out of your Chase Card Services account. Choose the right card for your needs, use it responsibly, take advantage of rewards and benefits, manage your account online, and keep your information secure.

Next: Explore other articles to learn more about Chase Card Services and other financial topics.

Conclusion - Chase Card Services

Chase Card Services offers a comprehensive suite of financial products and services designed to meet the diverse needs of individuals and businesses. These services include a wide range of credit cards, debit cards, and prepaid cards, as well as a variety of online and mobile banking tools. Chase Card Services is committed to providing exceptional customer service and building lasting relationships with its customers.

Chase Card Services offers a number of key benefits, including convenience, flexibility, rewards, security, customer service, innovation, value, and trust. These benefits make Chase Card Services a valuable choice for consumers who are looking for a convenient, secure, and rewarding way to manage their finances.

If you are looking for a financial partner that can help you achieve your financial goals, Chase Card Services is a great option. Chase offers a wide range of products and services to meet your needs, and is committed to providing excellent customer service. To learn more about Chase Card Services, visit the Chase website or contact a Chase representative.

Unveiling The Enigmatic Sagittarius Male: His Intriguing Traits

Stay Informed With AMG News.Com: Your Source For Reliable News

Dwight Howard's Net Worth: Unlocking The Fortune Of The NBA Legend