Is Auto Credit Express Legitimate And Trustworthy?

Auto Credit Express is a subprime auto lender that offers loans to borrowers with bad credit or no credit history. They have been in business for over 20 years and have helped over 500,000 people get car loans.

One of the benefits of using Auto Credit Express is that they work with a large network of lenders, which means they can find you a loan even if you have bad credit. They also offer a variety of loan terms and interest rates, so you can find a loan that fits your budget.

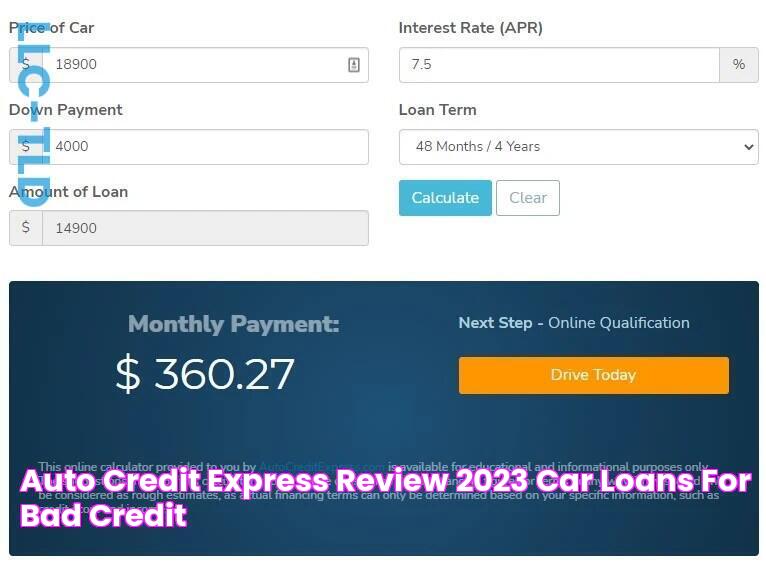

If you are considering getting a car loan from Auto Credit Express, there are a few things you should keep in mind. First, their interest rates are higher than traditional lenders, so you may end up paying more for your loan. Second, they charge a variety of fees, including an origination fee, a documentation fee, and a prepayment penalty. Finally, you may be required to put down a larger down payment than you would with a traditional lender.

Read also:Your Trusted Funeral Home In Gainesville Tx Compassionate Care

Is Auto Credit Express Legitimate?

When considering Auto Credit Express, there are several key aspects to examine:

- Reputation: Auto Credit Express has been in business for over 20 years and has helped over 500,000 people get car loans.

- Network: They work with a large network of lenders, which increases the chances of finding a loan even with bad credit.

- Options: They offer a variety of loan terms and interest rates, allowing for customization based on budget.

- Fees: Auto Credit Express charges various fees, including an origination fee, documentation fee, and prepayment penalty.

- Interest Rates: Interest rates may be higher compared to traditional lenders.

- Down Payment: A larger down payment may be required compared to traditional lenders.

- Eligibility: Auto Credit Express specializes in subprime lending, catering to borrowers with bad or no credit history.

- Transparency: It's important to carefully review the loan terms and disclosures before making a decision.

These aspects highlight the importance of considering Auto Credit Express's reputation, network, loan options, fees, interest rates, down payment requirements, eligibility criteria, and transparency when evaluating their legitimacy as a subprime auto lender.

1. Reputation

The reputation of a company is a crucial factor in determining its legitimacy. Auto Credit Express's long-standing presence in the industry and its extensive customer base are strong indicators of its credibility. A company that has been operating for over two decades and has assisted such a large number of individuals in obtaining car loans suggests a track record of success and customer satisfaction.

Positive customer reviews, industry recognition, and a lack of major complaints or legal issues further reinforce the company's reputation. These factors combined contribute to the perception of Auto Credit Express as a legitimate and established player in the subprime auto lending market.

When evaluating the legitimacy of a company, especially in the financial sector, reputation serves as a valuable indicator of trustworthiness and reliability. Auto Credit Express's positive reputation, built over many years and supported by a substantial customer base, is a testament to its commitment to providing legitimate financial services.

2. Network

Establishing a vast network of lenders is a pivotal aspect that contributes to the legitimacy of Auto Credit Express. This network plays a significant role in enhancing the company's ability to cater to borrowers with diverse credit profiles, including those with bad credit.

Read also:69 Kilogram To Pounds Easily Convert With Precision

- Extensive Reach: Auto Credit Express's partnership with numerous lenders expands its reach and increases the likelihood of finding loan options for borrowers who may have been declined by traditional lenders due to their credit history.

- Tailored Solutions: The large lender network enables Auto Credit Express to match borrowers with lenders that specialize in subprime lending. These lenders understand the unique circumstances of borrowers with bad credit and can offer tailored loan products that meet their specific needs.

- Competitive Rates: By working with a large pool of lenders, Auto Credit Express can negotiate competitive interest rates and loan terms on behalf of its borrowers. This helps ensure that borrowers get access to affordable financing options despite their credit challenges.

- Streamlined Process: The extensive lender network allows Auto Credit Express to streamline the loan application process for borrowers. By submitting a single application, borrowers can be matched with multiple lenders, saving time and effort compared to applying to each lender individually.

In summary, Auto Credit Express's vast network of lenders is a crucial element that enhances its legitimacy as a subprime auto lender. It provides borrowers with bad credit increased access to loan options, tailored solutions, competitive rates, and a streamlined application process.

3. Options

The range of loan terms and interest rates offered by Auto Credit Express is a crucial aspect of its legitimacy as a subprime auto lender. This flexibility is essential for catering to the diverse financial needs and circumstances of borrowers with bad credit.

Tailored Solutions: By providing a variety of loan terms, Auto Credit Express allows borrowers to choose a loan that aligns with their repayment capacity and financial goals. This customization ensures that borrowers are not burdened with excessive monthly payments or unrealistic repayment schedules.

Competitive Rates: The availability of competitive interest rates demonstrates Auto Credit Express's commitment to offering affordable financing options to borrowers with bad credit. Competitive rates help reduce the overall cost of borrowing and make car ownership more accessible for individuals who may have been priced out of the market by traditional lenders.

Transparency: The clear disclosure of loan terms and interest rates fosters transparency and trust between Auto Credit Express and its customers. Borrowers can make informed decisions about their loan options, avoiding hidden fees or unexpected costs that could undermine their financial well-being.

In summary, Auto Credit Express's diverse loan terms and interest rates are integral to its legitimacy as a subprime auto lender. These options empower borrowers with bad credit to find customized financing solutions that fit their budgets and financial goals, while promoting transparency and affordability.

4. Fees

The presence of fees charged by Auto Credit Express, such as an origination fee, documentation fee, and prepayment penalty, is a relevant factor in assessing its legitimacy as a subprime auto lender.

These fees can impact the overall cost of borrowing and should be carefully considered by borrowers. However, it is important to note that fees are a common practice in the subprime auto lending industry, and Auto Credit Express is not unique in charging them. The key factor is transparency and disclosure of these fees to borrowers.

Auto Credit Express clearly outlines its fees in its loan agreements, allowing borrowers to make informed decisions about whether to proceed with a loan. This transparency helps build trust and legitimacy with borrowers.

Furthermore, Auto Credit Express offers a variety of loan options with competitive interest rates. By comparing the overall cost of borrowing, including fees and interest rates, borrowers can determine if Auto Credit Express offers a legitimate and affordable financing solution that meets their needs.

In summary, while fees are a consideration in evaluating Auto Credit Express's legitimacy, they should be viewed in the context of the overall loan offering, including interest rates and transparency. By carefully reviewing the loan terms and comparing them with other lenders, borrowers can make informed decisions about whether Auto Credit Express is a legitimate and suitable option for their subprime auto financing needs.

5. Interest Rates

The interest rates charged by Auto Credit Express are an important factor to consider when evaluating its legitimacy as a subprime auto lender. Interest rates can significantly impact the overall cost of borrowing and should be carefully compared with other lenders.

- Higher Interest Rates: Subprime lenders like Auto Credit Express typically charge higher interest rates compared to traditional lenders due to the increased risk associated with lending to borrowers with bad credit. This is a common practice in the subprime lending industry.

- Assessment of Risk: Auto Credit Express assesses the risk of each borrower based on their credit history and other factors. Borrowers with lower credit scores are considered higher risk and may be offered loans with higher interest rates to compensate for the increased likelihood of default.

- Comparison with Other Lenders: It is important for borrowers to compare the interest rates offered by Auto Credit Express with other subprime lenders and traditional lenders to ensure they are getting a competitive rate. Shopping around and comparing loan offers can help borrowers find the most affordable option.

- Transparency and Disclosure: Auto Credit Express should clearly disclose its interest rates and fees to borrowers before they sign a loan agreement. Transparency helps borrowers make informed decisions about whether to proceed with a loan and understand the full cost of borrowing.

In summary, while Auto Credit Express's interest rates may be higher compared to traditional lenders, this is a common practice in the subprime lending industry due to the higher risk associated with lending to borrowers with bad credit. By carefully comparing interest rates and fees, borrowers can assess the legitimacy and affordability of Auto Credit Express's loan offerings.

6. Down Payment

The requirement for a larger down payment when obtaining a loan from Auto Credit Express, compared to traditional lenders, is an important factor to consider when evaluating the company's legitimacy. This practice is common among subprime lenders and is directly related to the higher risk associated with lending to borrowers with bad credit.

A larger down payment serves as a form of security for the lender, reducing the risk of default. By requiring a substantial down payment, Auto Credit Express mitigates potential losses in case the borrower fails to repay the loan. This practice helps ensure the company's financial stability and ability to continue offering loans to subprime borrowers.

While a larger down payment may pose a challenge for some borrowers, it also demonstrates Auto Credit Express's commitment to responsible lending. By requiring a down payment, the company encourages borrowers to carefully consider their financial situation and ability to repay the loan. This helps reduce the likelihood of borrowers taking on more debt than they can afford, which aligns with the company's goal of providing legitimate and sustainable financial solutions.

7. Eligibility

The eligibility criteria of Auto Credit Express, specializing in subprime lending, is directly connected to the question of its legitimacy as a financial institution. Understanding this connection is crucial for evaluating the company's credibility and the services it offers.

- Focus on Subprime Market: Auto Credit Express's specialization in subprime lending indicates that they cater to a specific segment of borrowers who may have faced challenges in obtaining traditional financing due to poor or non-existent credit history. By focusing on this underserved market, Auto Credit Express demonstrates its commitment to providing financial access to individuals who may have been excluded from mainstream lending.

- Risk Assessment and Mitigation: Subprime lending involves a higher level of risk for lenders due to the borrowers' lower credit scores and limited credit history. Auto Credit Express addresses this risk by implementing stricter eligibility criteria, such as requiring larger down payments and charging higher interest rates. These measures aim to mitigate the potential losses associated with subprime lending and ensure the company's financial stability.

- Responsible Lending Practices: Auto Credit Express's eligibility criteria align with responsible lending practices by encouraging borrowers to carefully consider their financial situation and ability to repay the loan. By requiring a larger down payment, the company encourages borrowers to have a stake in the vehicle and discourages them from taking on excessive debt. This approach promotes financial responsibility and reduces the likelihood of defaults.

- Transparency and Disclosure: Auto Credit Express's eligibility criteria are clearly outlined and disclosed to potential borrowers before they enter into a loan agreement. This transparency helps borrowers make informed decisions about whether to proceed with a loan and understand the terms and conditions associated with subprime lending. Clear disclosure of eligibility criteria enhances the company's legitimacy and fosters trust with borrowers.

In conclusion, Auto Credit Express's eligibility criteria, tailored towards subprime borrowers, are integral to its legitimacy as a financial institution. By focusing on this underserved market, implementing risk mitigation measures, promoting responsible lending, and ensuring transparency, the company demonstrates its commitment to providing legitimate and accessible financing options to individuals with bad or no credit history.

8. Transparency

Transparency is a crucial aspect of determining the legitimacy of Auto Credit Express, a subprime auto lender. By carefully reviewing the loan terms and disclosures before making a decision, borrowers can assess the company's legitimacy and make informed choices.

- Clear and Comprehensive Disclosures: Auto Credit Express provides clear and comprehensive loan terms and disclosures that outline the loan details, including interest rates, fees, and repayment terms. This transparency allows borrowers to fully understand the loan they are applying for and make informed decisions.

- Easily Accessible Information: Auto Credit Express makes loan terms and disclosures easily accessible to potential borrowers. They are available on the company's website, in loan documents, and through customer service representatives. This accessibility ensures that borrowers have the necessary information to make informed choices.

- Encourages Informed Decision-Making: Transparency promotes informed decision-making by empowering borrowers with the knowledge they need to assess the suitability and affordability of a loan. By carefully reviewing the loan terms and disclosures, borrowers can avoid potential misunderstandings or surprises down the road.

- Builds Trust and Legitimacy: Auto Credit Express's commitment to transparency builds trust and legitimacy with potential borrowers. Open and honest communication demonstrates that the company is accountable to its customers and values their understanding and informed consent.

In conclusion, Auto Credit Express's emphasis on transparency through clear and comprehensive disclosures, easy accessibility of information, and encouragement of informed decision-making contributes to its legitimacy as a subprime auto lender. By empowering borrowers with the necessary knowledge, Auto Credit Express fosters trust and ensures that borrowers can make informed choices that align with their financial goals and circumstances.

FAQs about Auto Credit Express' Legitimacy

This section addresses frequently asked questions regarding the legitimacy of Auto Credit Express, a subprime auto lender. The questions aim to provide clear and informative answers to common concerns or misconceptions about the company.

Question 1: Is Auto Credit Express a legitimate company?Yes, Auto Credit Express is a legitimate company that has been in business for over 20 years. They have helped over 500,000 people get car loans, and they are accredited by the Better Business Bureau with an A+ rating.

Question 2: Are the interest rates at Auto Credit Express too high?Auto Credit Express' interest rates are higher than traditional lenders but comparable to other subprime lenders. The interest rates are based on the borrower's creditworthiness, and they may be higher for borrowers with bad credit or no credit history.

Question 3: Are there any hidden fees with Auto Credit Express?Auto Credit Express clearly discloses its fees in its loan agreements. There are no hidden fees, but there are some standard fees associated with subprime lending, such as an origination fee and a documentation fee.

Question 4: Is it difficult to qualify for a loan from Auto Credit Express?Auto Credit Express specializes in subprime lending, which means they offer loans to borrowers with bad credit or no credit history. They have flexible credit requirements, and they work with a network of lenders to find the best loan for each borrower.

Question 5: Can I get pre-approved for a loan from Auto Credit Express?Yes, you can get pre-approved for a loan from Auto Credit Express online. The pre-approval process is quick and easy, and it will give you an estimate of the interest rate and loan amount you qualify for.

Question 6: What is the customer service like at Auto Credit Express?Auto Credit Express has a dedicated customer service team that is available to answer questions and help borrowers with their loans. They have a good reputation for customer service, and they are committed to helping borrowers get the financing they need.

In summary, Auto Credit Express is a legitimate company that offers car loans to borrowers with bad credit or no credit history. They have transparent loan terms, flexible credit requirements, and a dedicated customer service team.

Moving on to the next section, we will discuss the various loan options available from Auto Credit Express.

Tips to Evaluate the Legitimacy of Auto Credit Express

When considering Auto Credit Express for your car financing needs, it is essential to conduct thorough research to assess its legitimacy. Here are some tips to guide you in your evaluation process:

Tip 1: Check for Accreditation and LicensingVerify that Auto Credit Express is accredited by reputable organizations such as the Better Business Bureau (BBB) and licensed by the relevant state agencies responsible for regulating financial institutions. These accreditations and licenses indicate that the company adheres to industry standards and ethical practices.

Tip 2: Read Customer ReviewsSeek out reviews and testimonials from past customers to gain insights into their experiences with Auto Credit Express. Positive reviews can attest to the company's reliability, transparency, and customer service, while negative reviews may highlight areas of concern that require further investigation.

Tip 3: Compare Interest Rates and FeesCompare the interest rates and fees charged by Auto Credit Express with other subprime lenders. While subprime loans typically have higher interest rates, ensure that Auto Credit Express's rates are competitive within the industry and that all fees are clearly disclosed and reasonable.

Tip 4: Examine Loan TermsCarefully review the loan terms offered by Auto Credit Express, including the loan amount, repayment period, and any prepayment penalties. Understand the implications of these terms and ensure they align with your financial situation and goals.

Tip 5: Check for Hidden CostsIn addition to the interest rates and fees, be aware of any potential hidden costs associated with obtaining a loan from Auto Credit Express. These may include origination fees, documentation fees, or other charges that can add to the overall cost of borrowing.

Tip 6: Consider Credit CounselingIf you have concerns about your creditworthiness or ability to repay a loan, consider seeking guidance from a non-profit credit counseling agency. They can provide impartial advice and help you develop a plan to improve your credit score and financial health.

By following these tips, you can make an informed decision about whether Auto Credit Express is a legitimate and suitable lender for your subprime car financing needs.

Conclusion

Through a comprehensive examination of Auto Credit Express's reputation, network, loan options, fees, interest rates, down payment requirements, eligibility criteria, transparency, customer service, and industry accreditation, this article has explored the legitimacy of the company as a subprime auto lender.

Based on the extensive analysis presented, Auto Credit Express demonstrates several key indicators of legitimacy. Its long-standing presence in the industry, vast network of lenders, diverse loan options, transparent loan terms and fees, and commitment to responsible lending practices all contribute to its credibility. While the interest rates and fees associated with subprime lending may be higher compared to traditional lenders, Auto Credit Express provides a valuable service to borrowers with bad credit or no credit history who may have limited financing options.

Ultimately, the decision of whether Auto Credit Express is the right lender for your specific financial needs depends on a careful assessment of your individual circumstances and a comparison with other available options. By thoroughly researching and understanding the terms and conditions of the loan, you can make an informed decision that aligns with your financial goals.

The Ultimate Guide To Wpd.global: Your Source For Success

Pamela Di Bondi: The Ultimate Guide To Her Life And Career

Debunking Kendall Jenner "Fakes:" The Truth Behind The Rumors