Discover Exclusive Chase Card Benefits Today

Chase Card Benefits include special rewards, discounts, and services offered to cardholders of Chase credit cards and debit cards. These benefits may vary depending on the specific card and card tier, but commonly include rewards points, cash back, travel rewards, purchase protection, extended warranties, and access to exclusive events and experiences.

Chase Card Benefits can provide cardholders with significant value and savings. Rewards points can be redeemed for travel, gift cards, merchandise, and other rewards. Cash back can be used to offset purchases or redeemed for cash. Travel rewards can be used to book flights, hotels, and rental cars. Purchase protection and extended warranties provide peace of mind in case of theft, damage, or malfunction of purchased items. Exclusive events and experiences can provide cardholders with access to unique and memorable activities.

In addition to the benefits mentioned above, Chase Card Benefits also include a variety of services designed to make banking and financial management easier and more convenient. These services may include online and mobile banking, bill pay, and access to financial advisors. Chase Card Benefits are an important part of the value proposition for Chase credit cards and debit cards. They provide cardholders with a range of rewards, discounts, and services that can save them money, earn rewards, and make their lives easier.

Read also:Discover The Extraordinary World Of Erome Makay

Chase Card Benefits

Chase Card Benefits are a set of rewards, discounts, and services offered to cardholders of Chase credit cards and debit cards. These benefits can provide cardholders with significant value and savings.

- Rewards Points

- Cash Back

- Travel Rewards

- Purchase Protection

- Extended Warranties

- Exclusive Events and Experiences

Rewards points can be redeemed for travel, gift cards, merchandise, and other rewards. Cash back can be used to offset purchases or redeemed for cash. Travel rewards can be used to book flights, hotels, and rental cars. Purchase protection and extended warranties provide peace of mind in case of theft, damage, or malfunction of purchased items. Exclusive events and experiences can provide cardholders with access to unique and memorable activities.

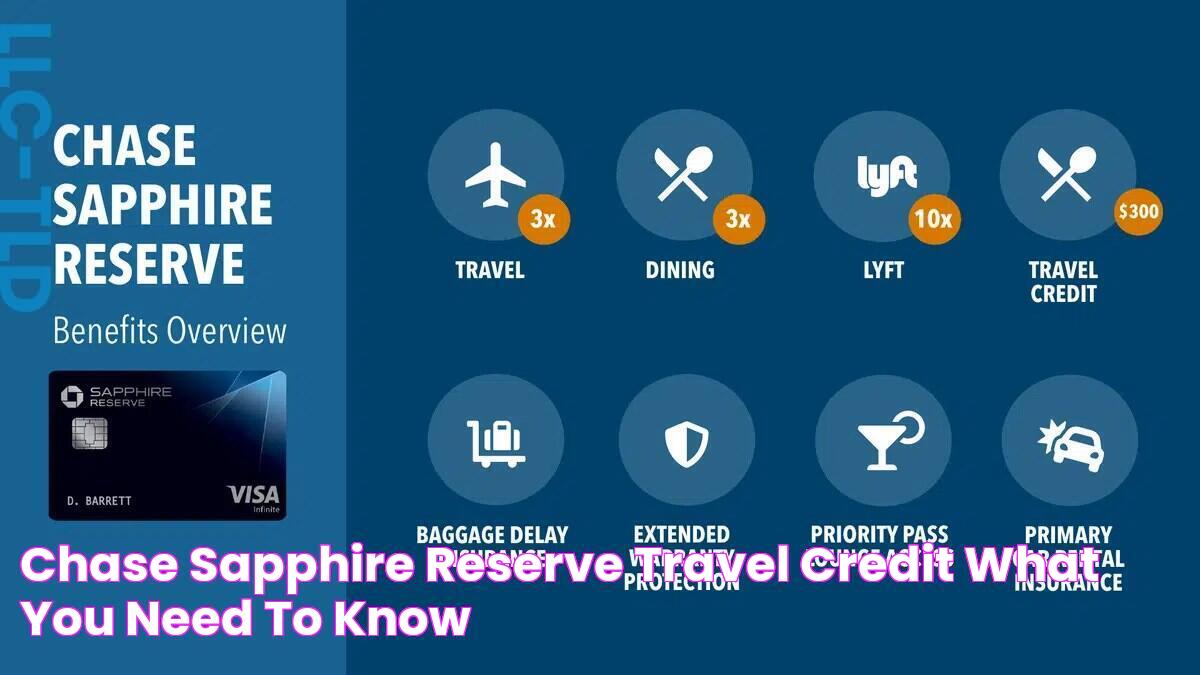

For example, the Chase Sapphire Reserve card offers cardholders 3x points on dining and travel, 1x point on all other purchases, a $300 annual travel credit, and access to airport lounges. The Chase Freedom Flex card offers cardholders 5% cash back on rotating categories, 1% cash back on all other purchases, and a 0% introductory APR on balance transfers for 15 months.

Chase Card Benefits are an important part of the value proposition for Chase credit cards and debit cards. They provide cardholders with a range of rewards, discounts, and services that can save them money, earn rewards, and make their lives easier.

1. Rewards Points

Rewards points are a type of currency that can be earned by using a credit card or debit card. They can be redeemed for a variety of rewards, such as travel, gift cards, merchandise, and cash back. Rewards points are a valuable part of chasecardbenefits, as they allow cardholders to earn rewards on their everyday spending.

There are many different ways to earn rewards points with Chase cards. Some cards offer bonus points for spending in certain categories, such as dining or travel. Other cards offer points for every dollar spent. Cardholders can also earn points by using Chase's online shopping portal or by referring friends and family to Chase cards.

Read also:Uncover Taylor Swifts Towering Height All The Details

Once cardholders have earned rewards points, they can redeem them for a variety of rewards. Some of the most popular redemption options include travel, gift cards, and cash back. Cardholders can also redeem points for merchandise, experiences, and charitable donations.

Rewards points can be a valuable way to save money and earn rewards on everyday spending. Chase offers a variety of credit cards and debit cards that earn rewards points, so cardholders can choose the card that best fits their spending habits and lifestyle.

2. Cash Back

Cash back is a type of reward that cardholders can earn when they use their credit card or debit card. It is a popular reward because it is simple and flexible. Cardholders can redeem cash back for statement credits, direct deposits, or gift cards.

- Earning Cash Back

There are many different ways to earn cash back with Chase cards. Some cards offer cash back on all purchases, while others offer bonus cash back in certain categories, such as dining, travel, or gas. Cardholders can also earn cash back by using Chase's online shopping portal or by referring friends and family to Chase cards.

- Redeeming Cash Back

Once cardholders have earned cash back, they can redeem it for a variety of rewards. The most popular redemption option is a statement credit, which will reduce the amount of money owed on the cardholder's credit card statement. Cardholders can also redeem cash back for direct deposits into their bank account or for gift cards to their favorite stores.

- Benefits of Cash Back

There are many benefits to earning cash back with Chase cards. Cash back is a flexible reward that can be used for anything. It is also a simple reward to understand and redeem. Plus, Chase offers a variety of credit cards and debit cards that earn cash back, so cardholders can choose the card that best fits their spending habits and lifestyle.

- Cash Back vs. Other Rewards

Cash back is a popular type of reward, but it is not the only type of reward that Chase offers. Cardholders can also earn rewards points, travel rewards, and exclusive experiences. The best type of reward for a particular cardholder will depend on their individual spending habits and lifestyle.

Cash back is a valuable part of chasecardbenefits. It is a simple, flexible, and rewarding way to save money on everyday spending. Chase offers a variety of credit cards and debit cards that earn cash back, so cardholders can choose the card that best fits their needs.

3. Travel Rewards

Travel rewards are a type of reward that cardholders can earn when they use their credit card or debit card to book travel expenses. It is a popular reward because it can help cardholders save money on their travel costs. Chase offers a variety of credit cards that earn travel rewards, so cardholders can choose the card that best fits their travel needs and budget.

There are many different ways to earn travel rewards with Chase cards. Some cards offer bonus rewards for spending on travel expenses, such as flights, hotels, and rental cars. Other cards offer rewards on all purchases, which can be redeemed for travel. Cardholders can also earn travel rewards by using Chase's online shopping portal or by referring friends and family to Chase cards.

Once cardholders have earned travel rewards, they can redeem them for a variety of travel expenses. Some of the most popular redemption options include flights, hotels, and rental cars. Cardholders can also redeem rewards for gift cards to their favorite travel providers or for experiences, such as tours and activities.

Travel rewards can be a valuable way to save money on travel expenses. Chase offers a variety of credit cards that earn travel rewards, so cardholders can choose the card that best fits their travel needs and budget. By using a Chase credit card to book travel expenses, cardholders can earn rewards that can be redeemed for future travel.

4. Purchase Protection

Purchase Protection is a valuable benefit offered by many Chase credit cards. It provides cardholders with peace of mind knowing that they are protected against theft, damage, or loss of their purchased items.

- Coverage

Purchase Protection typically covers items purchased with a Chase credit card within a certain time frame, usually 90 to 120 days. The coverage may include accidental damage, theft, or loss. Some Chase cards also offer extended warranty protection, which can extend the manufacturer's warranty on covered items.

- Exclusions

It is important to note that Purchase Protection does not cover all items. Some common exclusions include items purchased for business purposes, items purchased outside of the United States, and items that are considered to be "high-risk" (such as jewelry, electronics, and collectibles).

- Filing a Claim

If an item covered by Purchase Protection is lost, stolen, or damaged, the cardholder must file a claim with Chase. The claim must be filed within a certain time frame, usually 60 to 90 days from the date of the incident. Cardholders will need to provide documentation of the purchase, such as a receipt or invoice.

- Benefits

Purchase Protection can provide cardholders with significant benefits. It can help to reduce the financial burden of replacing or repairing damaged or stolen items. It can also provide peace of mind knowing that cardholders are protected against unexpected events.

Overall, Purchase Protection is a valuable benefit that can provide Chase credit cardholders with peace of mind and financial protection. It is important to understand the coverage and exclusions of Purchase Protection before using it, but it can be a valuable resource in the event of a covered incident.

5. Extended Warranties

Extended warranties are an important part of chasecardbenefits. They provide cardholders with peace of mind knowing that they are protected against unexpected repairs or replacements of their purchased items. Chase offers extended warranties on a variety of products, including electronics, appliances, and furniture.

There are many benefits to having an extended warranty. First, it can help to extend the life of your product. Second, it can save you money on repairs or replacements. Third, it can give you peace of mind knowing that you are protected against unexpected costs.

Here is an example of how an extended warranty can save you money. Let's say you purchase a new television for $1,000. The manufacturer's warranty only covers the television for one year. After one year, if the television breaks down, you will be responsible for paying for the repairs. However, if you purchase an extended warranty, you will be covered for a longer period of time, typically two or three years. If the television breaks down during this time period, the extended warranty will cover the cost of repairs or replacements.

Extended warranties are a valuable part of chasecardbenefits. They can provide cardholders with peace of mind and financial protection. When you purchase an extended warranty, you are essentially paying for peace of mind knowing that you are protected against unexpected repairs or replacements.

6. Exclusive Events and Experiences

Exclusive Events and Experiences are a valuable part of chasecardbenefits. They provide cardholders with access to unique and memorable experiences that are not available to the general public. These events and experiences can range from sporting events to concerts to fine dining experiences.

- Access to Presales and VIP Tickets

Chase cardholders often have access to presales and VIP tickets for popular events. This means that they can get tickets to sold-out shows and events before the general public. They may also be able to purchase VIP tickets that include perks such as meet-and-greets with celebrities and access to exclusive lounges.

- Invitations to Exclusive Events

Chase cardholders may also receive invitations to exclusive events, such as private concerts, movie screenings, and sporting events. These events are typically not open to the general public and offer cardholders a chance to experience something truly unique.

- Experiences with Partners

Chase has partnered with a number of companies to offer cardholders exclusive experiences. For example, Chase cardholders can use their points to book cooking classes with renowned chefs or to attend wine tastings at exclusive wineries.

- Redeeming Points for Experiences

Many Chase cards allow cardholders to redeem their points for exclusive events and experiences. This is a great way to use points to create lasting memories.

Overall, Exclusive Events and Experiences are a valuable part of chasecardbenefits. They provide cardholders with access to unique and memorable experiences that are not available to the general public. Whether you are looking to attend a sold-out concert or to experience a once-in-a-lifetime event, Chase cardholders have access to the best that life has to offer.

FAQs

This section provides answers to frequently asked questions (FAQs) about Chase Card Benefits. These FAQs are designed to provide a better understanding of the benefits and how to use them.

Question 1: What are Chase Card Benefits?Chase Card Benefits are a set of rewards, discounts, and services offered to cardholders of Chase credit cards and debit cards. These benefits can provide cardholders with significant value and savings.

Question 2: How do I activate my Chase Card Benefits?Chase Card Benefits are automatically activated when you receive your card. However, you may need to activate certain benefits, such as travel insurance or purchase protection, by calling the number on the back of your card or logging into your online account.

Question 3: How do I earn rewards points?You can earn rewards points by using your Chase credit card or debit card for everyday purchases. Some cards offer bonus points for spending in certain categories, such as dining or travel.

Question 4: How do I redeem my rewards points?You can redeem your rewards points for a variety of rewards, such as travel, gift cards, merchandise, and cash back. You can redeem points online, by phone, or through the Chase mobile app.

Question 5: What is Purchase Protection?Purchase Protection is a benefit that protects your purchases against theft, damage, or loss. It is typically available on Chase credit cards and provides coverage for 90 to 120 days after the date of purchase.

Question 6: What is Extended Warranty?Extended Warranty is a benefit that extends the manufacturer's warranty on your purchases. It is typically available on Chase credit cards and provides coverage for an additional year or two after the manufacturer's warranty expires.

These are just a few of the frequently asked questions about Chase Card Benefits. For more information, please visit the Chase website or call the number on the back of your card.

Transition to the next article section: Chase Card Benefits provide a variety of rewards, discounts, and services that can save you money and make your life easier. By understanding the benefits and how to use them, you can get the most out of your Chase credit card or debit card.

Tips to Maximize Chase Card Benefits

Chase Card Benefits offer a wide range of rewards, discounts, and services that can provide cardholders with significant value and savings. By following these tips, you can maximize the benefits of your Chase credit card or debit card.

Tip 1: Understand Your Benefits

The first step to maximizing your Chase Card Benefits is to understand what benefits are available to you. Take some time to read your cardmember agreement and explore the Chase website to learn about all the benefits that your card offers.

Tip 2: Use Your Card for Everyday Purchases

The best way to earn rewards points and other benefits is to use your Chase card for everyday purchases. Some cards offer bonus rewards for spending in certain categories, such as dining or travel. Make it a habit to use your Chase card for all of your purchases, big and small.

Tip 3: Redeem Your Rewards Wisely

Once you have earned rewards points, it is important to redeem them wisely. Chase offers a variety of redemption options, including travel, gift cards, merchandise, and cash back. Consider your redemption options carefully and choose the option that provides the most value for you.

Tip 4: Take Advantage of Exclusive Offers and Experiences

Chase Card Benefits include access to exclusive offers and experiences, such as presales for tickets to popular events, invitations to exclusive events, and discounts on travel and dining. Be sure to take advantage of these offers to get the most out of your Chase card.

Tip 5: Use Your Card for Travel

If you travel frequently, using your Chase card for travel expenses can be a great way to earn rewards points and other benefits. Some Chase cards offer bonus rewards for spending on travel expenses, such as flights, hotels, and rental cars. Plus, many Chase cards offer travel insurance and other benefits that can protect you while you travel.

Summary

By following these tips, you can maximize the benefits of your Chase Card Benefits. From earning rewards points to redeeming them wisely, there are many ways to get the most out of your Chase credit card or debit card.

Transition to the article's conclusion: Chase Card Benefits are a valuable part of the Chase banking experience. By understanding your benefits and using your card wisely, you can save money, earn rewards, and enjoy exclusive offers and experiences.

Chase Card Benefits

Chase Card Benefits offer a wide range of rewards, discounts, and services that can provide cardholders with significant value and savings. By understanding the benefits of your Chase credit card or debit card and using it wisely, you can get the most out of your Chase card.

Some of the key benefits of Chase Card Benefits include:

- Rewards points that can be redeemed for travel, gift cards, merchandise, and cash back.

- Cash back on everyday purchases.

- Travel rewards, such as bonus points for spending on travel expenses and travel insurance.

- Purchase Protection, which protects your purchases against theft, damage, or loss.

- Extended Warranty, which extends the manufacturer's warranty on your purchases.

- Exclusive offers and experiences, such as presales for tickets to popular events and invitations to exclusive events.

By taking advantage of these benefits, you can save money, earn rewards, and enjoy exclusive offers and experiences. Chase Card Benefits are a valuable part of the Chase banking experience and can help you get the most out of your money.

Discover The Incredible Benefits Of Sugar Scrub For Radiant Skin

How To Win Publishers Clearing House: The Ultimate Guide [Discover Insider Secrets]

Explore Wave Armor Sandestin Fl: The Ultimate Coastal Protection Solution

.png)