Unlock The Power Of Ipers: Discover Its Incredible Benefits

"IPERS benefits" refers to the various advantages and financial assistance provided to members of the Illinois Pensioners' Retirement System (IPERS). These benefits are designed to help members prepare for and maintain financial security during retirement.

IPERS benefits include retirement annuities, disability benefits, death benefits, and healthcare coverage. The importance of these benefits cannot be overstated, as they provide a foundation for financial stability and well-being during retirement.

The history of IPERS benefits dates back to the establishment of the system in 1941. Since then, the benefits offered to members have evolved to meet the changing needs of retirees. Today, IPERS benefits are considered to be among the most comprehensive and competitive in the nation.

Read also:The Extraordinary Net Worth Of Kendra G Exploring Her Financial Success

IPERS Benefits

IPERS benefits are essential for ensuring the financial security of retirees in Illinois. These benefits provide a foundation for financial stability and well-being during retirement. Here are seven key aspects of IPERS benefits:

- Retirement annuities

- Disability benefits

- Death benefits

- Healthcare coverage

- Competitive rates

- Long-term stability

- Peace of mind

These benefits are essential for retirees because they provide a guaranteed source of income, protect against financial hardship in the event of disability or death, and help to cover the rising costs of healthcare. IPERS benefits are also competitively priced and are backed by the long-term stability of the Illinois Pensioners' Retirement System. As a result, IPERS benefits provide peace of mind and financial security for retirees in Illinois.

1. Retirement annuities

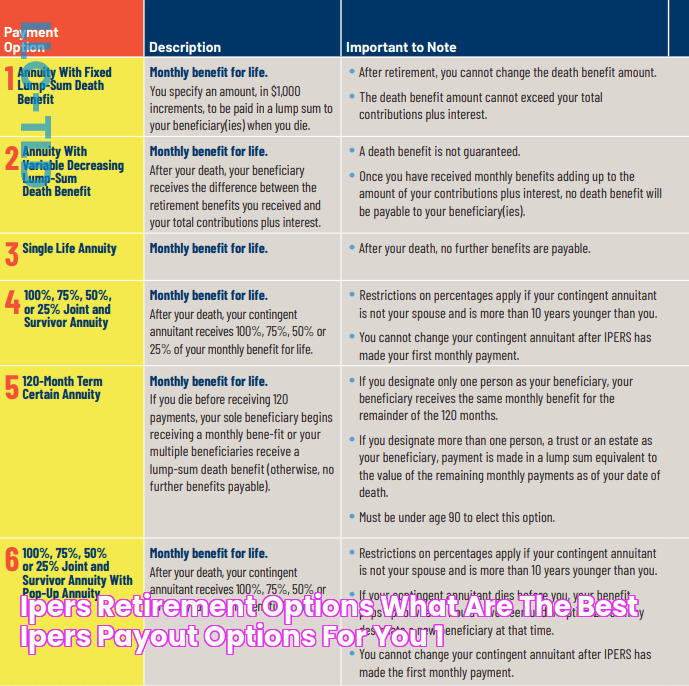

Retirement annuities are a key component of IPERS benefits, providing a guaranteed source of income for retirees in Illinois. An annuity is a contract between an individual and an insurance company, in which the individual makes a series of payments to the insurance company in exchange for a guaranteed stream of income payments for a specified period of time or for the rest of their life.

IPERS retirement annuities are funded through a combination of member contributions and employer contributions. The amount of the annuity payment is based on the amount of money that has been contributed to the plan, the member's age at retirement, and the length of time over which the annuity will be paid.

Retirement annuities are an important part of IPERS benefits because they provide retirees with a guaranteed source of income that they can count on to meet their living expenses. Annuities can also help retirees to manage their risk of outliving their savings, as they provide a steady stream of income that is not dependent on the performance of the stock market or other investments.

2. Disability benefits

Disability benefits are an essential component of IPERS benefits, providing financial assistance to members who are unable to work due to a disability. Disability benefits can be paid for up to 10 years, and the amount of the benefit is based on the member's salary and years of service.

Read also:Unveiling The Truth Meet The Real Singers Behind Milli Vanilli

Disability benefits are important because they provide a safety net for members who are unable to work due to a disability. These benefits can help to cover the costs of medical expenses, lost wages, and other expenses associated with a disability. Disability benefits can also help to prevent members from falling into poverty.

To be eligible for disability benefits, members must have at least 10 years of service and must be unable to perform their job duties due to a disability. Members must also provide medical documentation of their disability.

Disability benefits are an important part of IPERS benefits, providing financial security for members who are unable to work due to a disability. These benefits can help to cover the costs of medical expenses, lost wages, and other expenses associated with a disability. Disability benefits can also help to prevent members from falling into poverty.

3. Death benefits

Death benefits are an essential component of IPERS benefits, providing financial assistance to the beneficiaries of members who pass away. Death benefits can be paid in a lump sum or as a monthly annuity, and the amount of the benefit is based on the member's salary and years of service.

Death benefits are important because they provide financial security for the beneficiaries of members who pass away. These benefits can help to cover the costs of funeral expenses, outstanding debts, and other expenses associated with the death of a loved one. Death benefits can also help to prevent the beneficiaries from falling into poverty.

To be eligible for death benefits, the member must have at least one year of service and must have designated a beneficiary. The beneficiary can be a spouse, child, parent, or other person.

Death benefits are an important part of IPERS benefits, providing financial security for the beneficiaries of members who pass away. These benefits can help to cover the costs of funeral expenses, outstanding debts, and other expenses associated with the death of a loved one. Death benefits can also help to prevent the beneficiaries from falling into poverty.

4. Healthcare coverage

Healthcare coverage is an integral component of IPERS benefits, providing comprehensive medical, dental, and vision coverage to retirees and their dependents. This coverage helps to ensure that retirees have access to quality healthcare services, regardless of their income or health status.

- Medical coverage

IPERS medical coverage provides retirees with comprehensive medical coverage, including doctor visits, hospital stays, and prescription drugs. This coverage helps to ensure that retirees have access to the medical care they need to stay healthy and active.

- Dental coverage

IPERS dental coverage provides retirees with comprehensive dental coverage, including preventive care, fillings, and major dental work. This coverage helps to ensure that retirees can maintain good oral health and avoid costly dental problems.

- Vision coverage

IPERS vision coverage provides retirees with comprehensive vision coverage, including eye exams, glasses, and contact lenses. This coverage helps to ensure that retirees can maintain good vision and avoid costly eye problems.

The healthcare coverage provided by IPERS is an essential part of the benefits package offered to retirees. This coverage helps to ensure that retirees have access to quality healthcare services, regardless of their income or health status.

5. Competitive rates

Competitive rates are an essential component of IPERS benefits, helping to ensure that retirees can maintain their standard of living in retirement. IPERS benefits are designed to keep pace with inflation, so retirees can be confident that their benefits will continue to provide them with the financial security they need.

- Cost-of-living adjustments (COLAs)

IPERS benefits are adjusted annually for inflation, ensuring that retirees' benefits keep pace with the rising cost of living. This is an important feature of IPERS benefits, as it helps to protect retirees from losing purchasing power over time.

- Market-based investments

IPERS invests a portion of its assets in the stock market, which has the potential to generate higher returns than more conservative investments. This helps to keep IPERS benefits competitive with other retirement plans and to ensure that retirees can maintain their standard of living in retirement.

- Efficient operations

IPERS operates efficiently, keeping administrative costs low. This helps to ensure that more of the money contributed to IPERS is available to pay benefits to retirees.

- Long-term sustainability

IPERS is a well-funded pension plan with a long-term sustainability goal. This means that retirees can be confident that their benefits will be there for them when they need them.

The competitive rates offered by IPERS benefits are an important part of the value proposition that IPERS offers to its members. Retirees can be confident that their IPERS benefits will provide them with the financial security they need to enjoy their retirement years.

6. Long-term stability

Long-term stability is a critical aspect of IPERS benefits, ensuring that retirees can count on their benefits for the rest of their lives. IPERS is a well-funded pension plan with a long-term sustainability goal. This means that retirees can be confident that their benefits will be there for them when they need them.

- Strong funding

IPERS is funded by a combination of member contributions, employer contributions, and investment returns. The plan's assets are invested in a diversified portfolio of stocks, bonds, and real estate. This diversification helps to reduce risk and ensure that the plan has the resources to meet its long-term obligations.

- Conservative investment strategy

IPERS employs a conservative investment strategy that is designed to preserve capital and generate stable returns. The plan's investment portfolio is managed by a team of experienced professionals who are committed to protecting the plan's assets.

- Independent oversight

IPERS is overseen by an independent board of trustees. The board is responsible for setting the plan's investment strategy, approving the plan's budget, and ensuring that the plan is operated in accordance with the law.

- Long-term sustainability

IPERS is committed to long-term sustainability. The plan's funding strategy and investment strategy are designed to ensure that the plan will be able to meet its obligations to retirees for many years to come.

The long-term stability of IPERS benefits is a key reason why IPERS is one of the most trusted pension plans in the country. Retirees can be confident that their IPERS benefits will be there for them when they need them.

7. Peace of mind

Peace of mind is a priceless benefit that IPERS provides to its members. IPERS benefits are designed to provide retirees with the financial security they need to enjoy their retirement years. This can lead to a sense of peace of mind, knowing that their financial needs are taken care of.

- Financial security

One of the biggest sources of stress in retirement is financial insecurity. IPERS benefits can help to alleviate this stress by providing retirees with a guaranteed source of income. This can give retirees the peace of mind to enjoy their retirement years without worrying about their finances.

- Health and well-being

Financial security can also have a positive impact on health and well-being. Retirees who are financially secure are more likely to be healthy and active. They are also less likely to experience stress and anxiety.

- Legacy planning

IPERS benefits can also provide peace of mind for retirees who are concerned about their legacy. IPERS benefits can help to ensure that retirees have the financial resources they need to provide for their loved ones, both during their retirement and after they are gone.

- Sense of community

IPERS is more than just a pension plan. It is also a community of retirees who are committed to supporting each other. This sense of community can provide retirees with a sense of belonging and purpose, which can lead to greater peace of mind.

Peace of mind is an essential part of a happy and fulfilling retirement. IPERS benefits can help to provide retirees with the peace of mind they need to enjoy their retirement years.

FAQs about IPERS Benefits

The Illinois Pensioners' Retirement System (IPERS) provides a range of benefits to its members, including retirement annuities, disability benefits, death benefits, and healthcare coverage. These benefits are essential for ensuring the financial security of retirees in Illinois.

Question 1: What are the eligibility requirements for IPERS benefits?

To be eligible for IPERS benefits, members must have at least 10 years of service and must have reached the age of 65. However, members who have at least 8 years of service may be eligible for early retirement benefits.

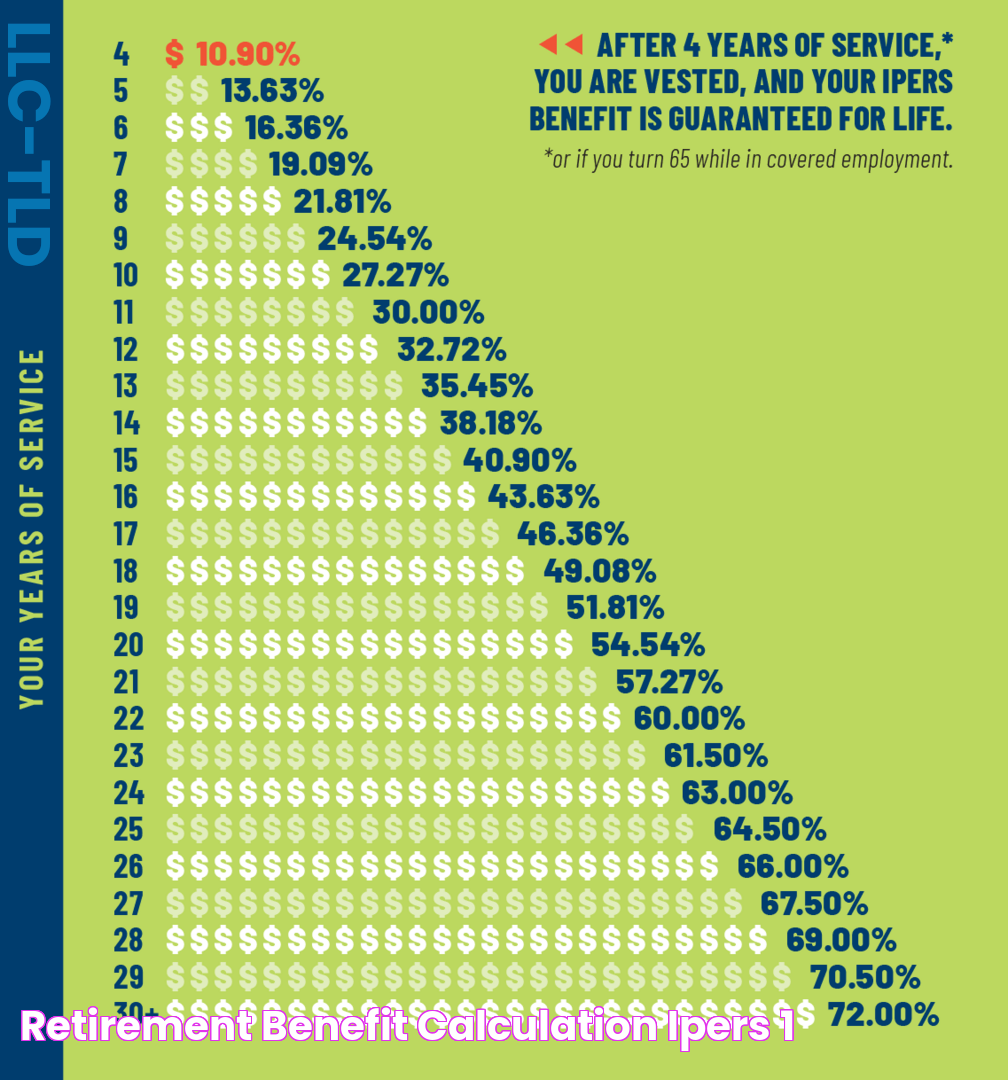

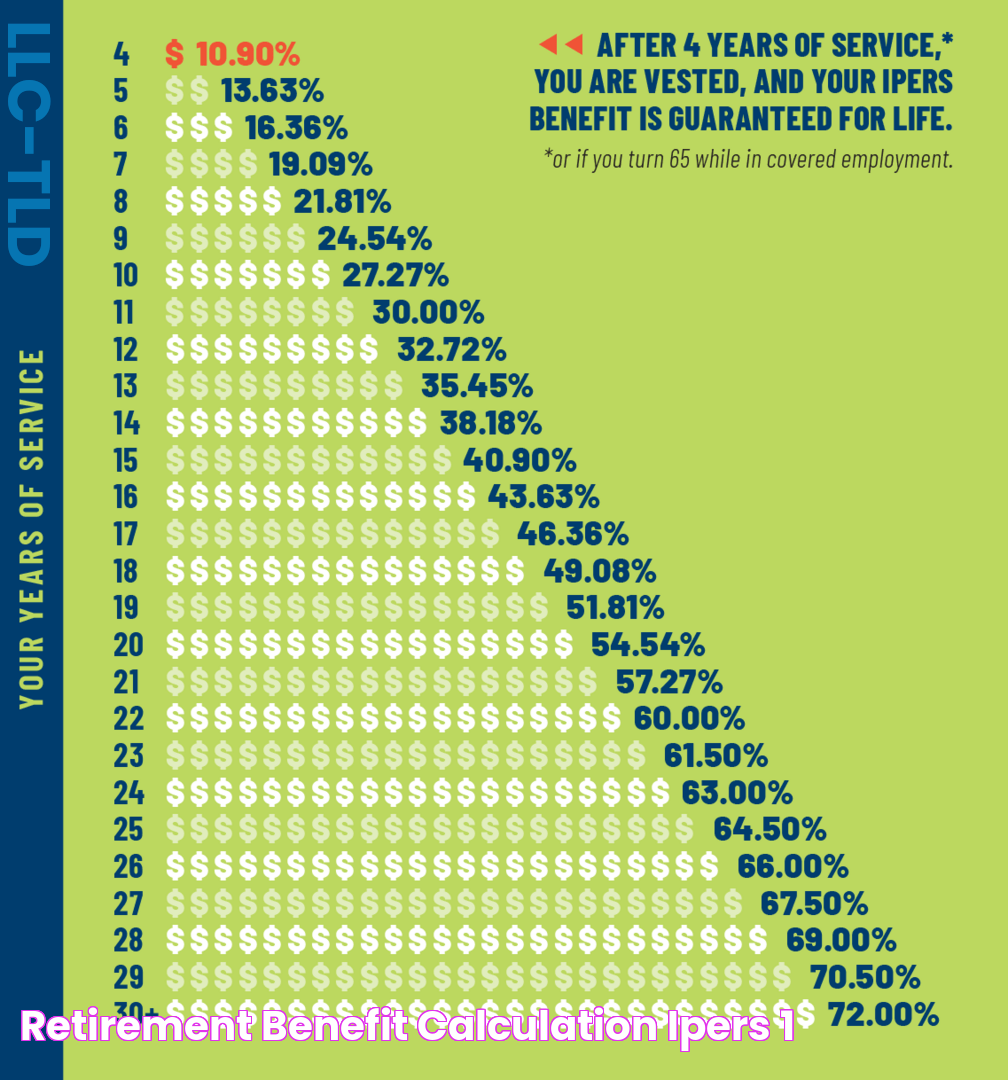

Question 2: How much will I receive in retirement benefits?

The amount of retirement benefits that you will receive depends on a number of factors, including your years of service, your salary history, and your age at retirement. You can use the IPERS benefit calculator to estimate your retirement benefits.

Question 3: What are the different types of disability benefits available?

IPERS offers two types of disability benefits: short-term disability benefits and long-term disability benefits. Short-term disability benefits are available to members who are unable to work due to a temporary disability. Long-term disability benefits are available to members who are unable to work due to a permanent disability.

Question 4: What are the eligibility requirements for death benefits?

To be eligible for death benefits, the member must have at least one year of service and must have designated a beneficiary. The beneficiary can be a spouse, child, parent, or other person.

Question 5: What is the cost of healthcare coverage?

The cost of healthcare coverage depends on the type of coverage that you choose and your age. IPERS offers a variety of healthcare coverage options, so you can choose the option that best meets your needs and budget.

Question 6: How can I apply for IPERS benefits?

You can apply for IPERS benefits online or by mail. You can find more information about how to apply for benefits on the IPERS website.

IPERS benefits are an essential part of the financial security of retirees in Illinois. If you are an IPERS member, we encourage you to learn more about the benefits that you are entitled to.

To learn more about IPERS benefits, please visit the IPERS website or call the IPERS Member Service Center at 1-800-843-4737.

Tips for Maximizing IPERS Benefits

The Illinois Pensioners' Retirement System (IPERS) provides a range of benefits to its members, including retirement annuities, disability benefits, death benefits, and healthcare coverage. These benefits are essential for ensuring the financial security of retirees in Illinois.

Tip 1: Maximize your contributions. The more you contribute to IPERS, the higher your retirement benefits will be. You can increase your contributions by making voluntary after-tax contributions.

Tip 2: Delay your retirement. The longer you work, the more years of service you will have, and the higher your retirement benefits will be. If you can afford to, consider delaying your retirement by a few years.

Tip 3: Take advantage of catch-up contributions. If you are behind on your retirement savings, you can make catch-up contributions to IPERS. Catch-up contributions are additional contributions that you can make in addition to your regular contributions.

Tip 4: Choose the right investment option. IPERS offers a variety of investment options for your retirement savings. Choose the option that best meets your risk tolerance and investment goals.

Tip 5: Get professional advice. If you are not sure how to maximize your IPERS benefits, you can get professional advice from a financial advisor.

Summary of key takeaways or benefits:

- Maximizing your IPERS benefits can help you to achieve financial security in retirement.

- There are a number of ways to maximize your IPERS benefits, including maximizing your contributions, delaying your retirement, taking advantage of catch-up contributions, choosing the right investment option, and getting professional advice.

- By following these tips, you can make the most of your IPERS benefits and enjoy a secure and comfortable retirement.

Transition to the article's conclusion:

IPERS benefits are an essential part of the financial security of retirees in Illinois. By following these tips, you can maximize your IPERS benefits and enjoy a secure and comfortable retirement.

IPERS Benefits

IPERS benefits are essential for ensuring the financial security of retirees in Illinois. These benefits provide a guaranteed source of income, protect against financial hardship in the event of disability or death, and help to cover the rising costs of healthcare. IPERS benefits are also competitively priced and are backed by the long-term stability of the Illinois Pensioners' Retirement System.

By maximizing your IPERS benefits, you can achieve financial security in retirement. There are a number of ways to maximize your IPERS benefits, including maximizing your contributions, delaying your retirement, taking advantage of catch-up contributions, choosing the right investment option, and getting professional advice. By following these tips, you can make the most of your IPERS benefits and enjoy a secure and comfortable retirement.

Buy Custom Hats In Canada From Lids Canada | Trusted Headwear Retailer

Josh Bersin's Predictions For The Future Of Work

Incredible Stories From The Nelson-Jameson Foundation