How Does IPERS Work: A Comprehensive Guide

IPERS is an acronym that stands for Illinois Public Employees Retirement System. It is a state-run pension system that provides retirement benefits to eligible employees of the state of Illinois and its local governments. IPERS was created in 1941 and is one of the largest public pension systems in the United States, with over 600,000 active and retired members.

IPERS is a defined benefit plan, which means that the amount of retirement benefits that a member receives is based on a formula that takes into account their years of service, salary, and age at retirement. IPERS also offers a variety of other benefits, including disability benefits, survivor benefits, and health insurance.

IPERS is an important part of the retirement planning process for many Illinois public employees. It provides a secure and reliable source of retirement income, and it can help members to achieve their financial goals.

Read also:The Ultimate Guide To Apponfly A Powerful App Testing Tool

how does ipers work

IPERS, the Illinois Public Employees Retirement System, is a defined benefit plan that provides retirement, disability, and survivor benefits to eligible employees of the state of Illinois and its local governments. Here are six key aspects of how IPERS works:

- Membership: Employees are automatically enrolled in IPERS if they are employed by the state of Illinois or a local government that participates in the system.

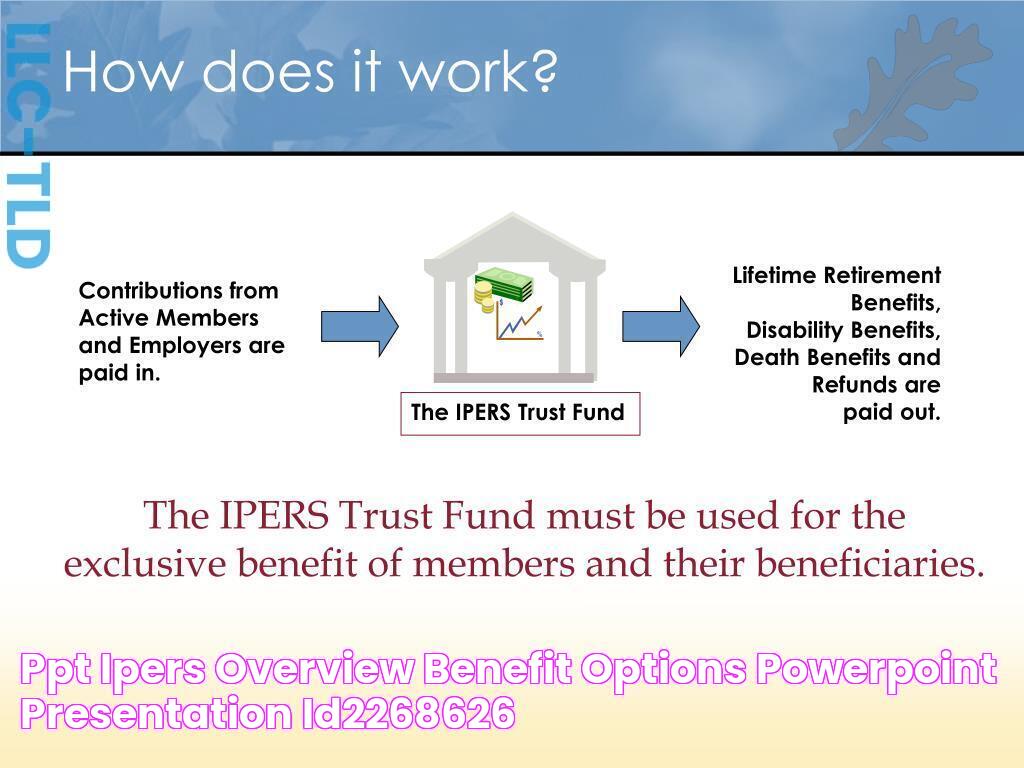

- Contributions: Employees contribute a percentage of their salary to IPERS on a pre-tax basis. Employers also contribute to IPERS on behalf of their employees.

- Benefits: IPERS provides a variety of benefits, including retirement benefits, disability benefits, survivor benefits, and health insurance.

- Retirement benefits: The amount of retirement benefits that a member receives is based on a formula that takes into account their years of service, salary, and age at retirement.

- Disability benefits: IPERS provides disability benefits to members who are unable to work due to a disability.

- Survivor benefits: IPERS provides survivor benefits to the surviving spouse and children of a member who dies.

These are just some of the key aspects of how IPERS works. For more information, please visit the IPERS website.

1. Membership

Membership is an important part of how IPERS works because it determines who is eligible for benefits. Only employees who are enrolled in IPERS can receive retirement, disability, and survivor benefits. Automatic enrollment ensures that all eligible employees are enrolled in IPERS and have the opportunity to build up their retirement savings.

There are several benefits to automatic enrollment. First, it helps to ensure that employees are saving for retirement early in their careers. This is important because the sooner employees start saving, the more time their money has to grow. Second, automatic enrollment can help to reduce the number of employees who retire without sufficient savings. This is because employees who are automatically enrolled in IPERS are more likely to continue contributing to the system, even if they change jobs.

Overall, automatic enrollment is an important part of how IPERS works. It helps to ensure that all eligible employees have the opportunity to save for retirement and receive benefits when they retire.

2. Contributions

Contributions are an important part of how IPERS works because they are the primary source of funding for the system. Employees contribute a percentage of their salary to IPERS on a pre-tax basis, which means that their contributions are deducted from their paycheck before taxes are calculated. Employers also contribute to IPERS on behalf of their employees, which helps to reduce the cost of retirement benefits for employees.

Read also:The amount of employee and employer contributions is set by law and varies depending on the employee's salary and years of service. In general, employees contribute a higher percentage of their salary to IPERS as they get closer to retirement age. This is because the closer an employee is to retirement, the more money they need to have saved in order to maintain their standard of living in retirement.Employee and employer contributions are invested by IPERS in a variety of assets, such as stocks, bonds, and real estate. The investment returns earned on these assets help to grow the IPERS fund and provide retirement benefits for members.Discover Kidulthoods Jessica Hardwick Behind The Scenes Of A Groundbreaking Film

The importance of contributions to how IPERS works cannot be overstated. Without contributions, IPERS would not be able to provide retirement benefits to its members. Contributions are essential for ensuring that IPERS remains a viable and secure retirement system for Illinois public employees.

3. Benefits

Benefits are a central aspect of how IPERS works because they are the primary reason why employees participate in the system. IPERS offers a wide range of benefits, which provides members with a secure and reliable source of income and support throughout their lives.

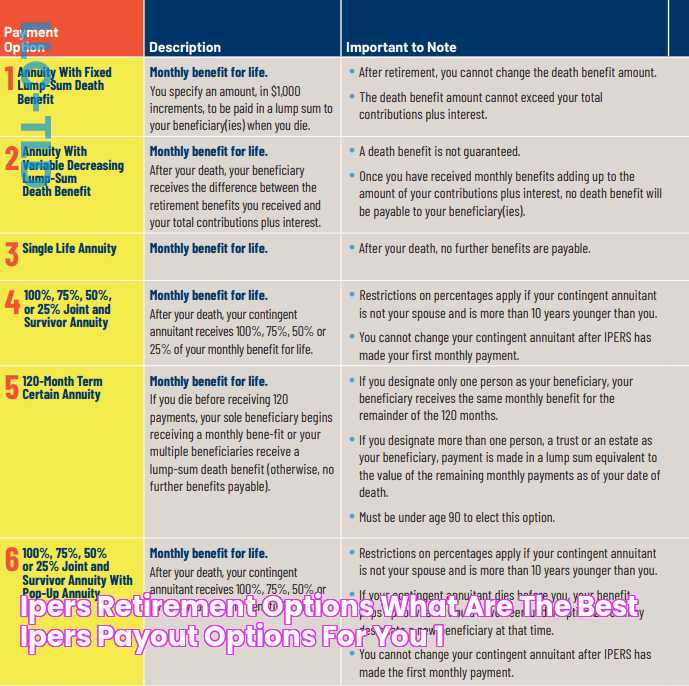

- Retirement benefits: Retirement benefits are the most well-known and important benefit offered by IPERS. These benefits provide members with a monthly income when they retire, which helps them to maintain their standard of living in retirement.

- Disability benefits: Disability benefits provide members with a monthly income if they are unable to work due to a disability. These benefits help to ensure that members have a financial safety net in the event that they become disabled.

- Survivor benefits: Survivor benefits provide members' surviving spouses and children with a monthly income if the member dies. These benefits help to ensure that members' families are financially secure in the event of their death.

- Health insurance: IPERS offers a variety of health insurance plans to members and their families. These plans help to reduce the cost of healthcare for members and their families, and they provide members with access to quality healthcare.

The benefits offered by IPERS are essential for ensuring the financial security of Illinois public employees and their families. These benefits provide members with a secure and reliable source of income and support throughout their lives, and they help to reduce the cost of healthcare for members and their families.

4. Retirement benefits

The formula used to calculate retirement benefits under IPERS is an important component of how IPERS works. This formula takes into account three key factors: years of service, salary, and age at retirement. By considering these factors, the formula ensures that members receive retirement benefits that are commensurate with their contributions to the system and their years of service.

Years of service is an important factor in determining retirement benefits because it reflects the amount of time that a member has contributed to IPERS. The more years of service a member has, the higher their retirement benefits will be. This is because members who have contributed to IPERS for a longer period of time have had more time to accumulate savings and earn investment returns.

Salary is another important factor in determining retirement benefits. This is because the amount of money that a member earns during their career has a direct impact on the amount of money that they will have available to save for retirement. Members who earn higher salaries will have more money available to contribute to IPERS, which will result in higher retirement benefits.

Age at retirement is also a factor in determining retirement benefits. This is because the age at which a member retires affects the number of years that they will receive retirement benefits. Members who retire at a younger age will receive retirement benefits for a longer period of time, which will result in higher total retirement benefits. Conversely, members who retire at an older age will receive retirement benefits for a shorter period of time, which will result in lower total retirement benefits.

The formula used to calculate retirement benefits under IPERS is designed to ensure that members receive retirement benefits that are fair and equitable. By considering years of service, salary, and age at retirement, the formula takes into account the individual circumstances of each member and provides them with a retirement benefit that is commensurate with their contributions to the system and their years of service.

5. Disability benefits

Disability benefits are an important part of how IPERS works because they provide a financial safety net for members who are unable to work due to a disability. These benefits help to ensure that members have a source of income if they become disabled and are unable to earn a living.

- Eligibility: Disability benefits are available to IPERS members who are unable to work due to a physical or mental disability. Members must meet certain eligibility requirements in order to receive disability benefits, including having worked a certain number of years and having made contributions to IPERS.

- Benefits: Disability benefits provide members with a monthly income if they are unable to work due to a disability. The amount of benefits that a member receives is based on their years of service and salary. Disability benefits are paid until the member reaches retirement age or is able to return to work.

- Importance: Disability benefits are an important part of IPERS because they provide members with a financial safety net in the event that they become disabled. These benefits help to ensure that members have a source of income if they are unable to work and are unable to earn a living.

Overall, disability benefits are an important part of how IPERS works. These benefits provide members with a financial safety net in the event that they become disabled. Disability benefits help to ensure that members have a source of income if they are unable to work and are unable to earn a living.

6. Survivor benefits

Survivor benefits are an essential component of how IPERS works because they provide financial support to the surviving family members of a deceased member. These benefits help to ensure that the surviving family members can maintain their standard of living and financial security in the event of the member's death.

Survivor benefits are available to the surviving spouse and children of a deceased member who met certain eligibility requirements, such as being married to the member for a certain number of years or having been financially dependent on the member. The amount of survivor benefits that a family member receives is based on the member's years of service and salary. Survivor benefits are paid until the surviving spouse remarries or dies, or until the children reach the age of 18 (or 22 if they are full-time students).

Survivor benefits are an important part of IPERS because they provide financial security to the surviving family members of a deceased member. These benefits help to ensure that the surviving family members can maintain their standard of living and financial security in the event of the member's death.

FAQs

This section addresses frequently asked questions about IPERS, the Illinois Public Employees Retirement System.

Question 1: Who is eligible to participate in IPERS?

Answer: Employees of the state of Illinois and its local governments are automatically enrolled in IPERS if they are not covered by another retirement system.

Question 2: How are IPERS benefits calculated?

Answer: IPERS benefits are calculated based on a formula that considers factors such as years of service, salary, and age at retirement.

Question 3: What types of benefits does IPERS offer?

Answer: IPERS offers a range of benefits, including retirement benefits, disability benefits, survivor benefits, and health insurance.

Question 4: How are IPERS contributions invested?

Answer: IPERS contributions are invested in a diversified portfolio of assets, including stocks, bonds, and real estate.

Question 5: What happens to my IPERS benefits if I leave my job?

Answer: If you leave your job before you are eligible for retirement, you can withdraw your IPERS contributions or leave them in the system to continue growing.

Question 6: How can I contact IPERS with questions?

Answer: You can contact IPERS by phone, email, or through their website.

These are just a few of the frequently asked questions about IPERS. For more information, please visit the IPERS website.

Transition to the next article section: Understanding the importance of IPERS for Illinois public employees.

Tips on Understanding How IPERS Works

IPERS, the Illinois Public Employees Retirement System, is a complex system with many moving parts, and understanding how it works is important for Illinois public employees who want to make the most of their retirement benefits.

Here are five tips for understanding how IPERS works:

Tip 1: Understand the different types of IPERS benefits. IPERS offers a variety of benefits, including retirement benefits, disability benefits, survivor benefits, and health insurance. Understanding the different types of benefits available can help you plan for your retirement and protect your family.

Tip 2: Calculate your IPERS benefits. IPERS provides an online tool that allows you to calculate your estimated retirement benefits. This tool can help you understand how your years of service, salary, and age at retirement will impact your benefits.

Tip 3: Make additional contributions to your IPERS account. You can make additional contributions to your IPERS account through the IPERS Member Self-Service portal. These additional contributions can help you increase your retirement benefits.

Tip 4: Stay informed about IPERS changes. IPERS regularly makes changes to its rules and regulations. It is important to stay informed about these changes so that you can make informed decisions about your retirement planning.

Tip 5: Talk to an IPERS representative. If you have questions about how IPERS works, you can talk to an IPERS representative. IPERS representatives can provide you with personalized information and help you understand your retirement options.

By following these tips, you can gain a better understanding of how IPERS works and make informed decisions about your retirement planning.

Summary: Understanding how IPERS works is essential for Illinois public employees who want to make the most of their retirement benefits. By following the tips above, you can gain a better understanding of IPERS and make informed decisions about your retirement planning.

Transition to the article's conclusion: Making the most of your IPERS benefits.

Conclusion

IPERS, the Illinois Public Employees Retirement System, is a complex system with many moving parts. Understanding how IPERS works is important for Illinois public employees who want to make the most of their retirement benefits.

This article has explored the different aspects of how IPERS works, including membership, contributions, benefits, and retirement benefits. We have also provided tips for understanding how IPERS works and making the most of your retirement benefits.

If you have any questions about how IPERS works, please contact an IPERS representative. IPERS representatives can provide you with personalized information and help you understand your retirement options.

The Ultimate Guide To IPERS: What It Is, How It Works, And Everything You Need To Know

Unlock The Meaning Of "Chama" In Portuguese With Alex Pereira

Charter Fishing Brielle: Experience The Thrill Of The Sea