The Ultimate Guide To Auto Credit Express Loan Reviews

"Auto credit express loan reviews" refer to assessments and opinions shared by individuals who have utilized the services of Auto Credit Express, a company specializing in connecting borrowers with lenders for auto loans. These reviews provide valuable insights into the company's loan offerings, application process, customer service, and overall experiences.

Understanding these reviews is crucial for potential borrowers seeking auto financing, as they offer firsthand accounts of the company's strengths and weaknesses. Positive reviews may indicate a lender's reliability, efficiency, and customer-centric approach, while negative reviews can highlight areas for improvement or potential drawbacks.

In exploring "auto credit express loan reviews," it's important to consider various aspects, including the loan terms, interest rates, eligibility criteria, and any additional fees associated with the loans. Additionally, assessing the company's reputation, industry standing, and customer support channels can provide a comprehensive understanding of its services.

Read also:The Aweinspiring Return Beauty In Black Season 2

Auto Credit Express Loan Reviews

When considering auto credit express loan reviews, several key aspects come into play, each offering valuable insights into the company's services and offerings.

- Transparency: Clear and upfront information about loan terms, rates, and fees.

- Efficiency: Streamlined application process and quick loan approvals.

- Customer Service: Responsive and helpful support throughout the loan process.

- Reputation: Industry standing and customer feedback on platforms like the Better Business Bureau.

- Eligibility: Loan options tailored to borrowers with varying credit profiles.

- Loan Terms: Flexible loan durations, interest rates, and repayment plans.

- Additional Fees: Any associated costs beyond the loan amount, such as origination or processing fees.

These aspects collectively contribute to the overall customer experience and satisfaction with Auto Credit Express loan services. Positive reviews often highlight transparency in loan terms and efficient processing, while negative reviews may point to areas where the company can improve its customer service or address concerns related to eligibility criteria or additional fees. By carefully considering these key aspects, potential borrowers can make informed decisions when choosing Auto Credit Express for their auto financing needs.

1. Transparency

Transparency plays a pivotal role in building trust and ensuring customer satisfaction in the financial industry. In the context of auto credit express loan reviews, transparency refers to the company's openness and clarity in providing information about its loan terms, interest rates, and any associated fees.

- Auto Credit Express reviews should indicate whether the company provides clear and concise loan agreements that outline the loan amount, repayment period, interest rate, and any prepayment penalties. This transparency helps borrowers make informed decisions and avoid unexpected costs.

- Reviews should assess whether Auto Credit Express discloses its interest rates upfront and explains how they are determined. Transparency in interest rates allows borrowers to compare loan offers from different lenders and choose the one that best suits their financial situation.

- Positive reviews often highlight Auto Credit Express's clarity in disclosing any additional fees, such as origination fees, processing fees, or late payment penalties. This transparency helps borrowers accurately estimate the total cost of the loan and avoid surprises.

- Reviews should indicate whether Auto Credit Express provides loan disclosures in a clear and easy-to-understand format. Transparent disclosures enable borrowers to grasp the key terms of the loan without confusion or ambiguity.

Transparency in loan terms, rates, and fees is crucial for building trust with customers and ensuring a positive borrowing experience. Positive auto credit express loan reviews that emphasize transparency indicate the company's commitment to ethical lending practices and customer satisfaction.

2. Efficiency

In the context of auto credit express loan reviews, efficiency is a key factor that significantly impacts customer satisfaction and overall borrowing experience. Efficiency encompasses the streamlined nature of the loan application process and the speed at which loan approvals are granted.

- Simplified Application Process: Positive reviews often highlight Auto Credit Express's user-friendly online loan application process. The reviews should indicate whether the application is straightforward, easy to navigate, and requires minimal documentation, making it convenient for borrowers to apply for loans.

- Rapid Loan Approvals: Quick loan approvals are another crucial aspect of efficiency. Reviews should assess whether Auto Credit Express promptly processes loan applications and provides timely approvals. Fast approvals enable borrowers to secure financing quickly, expediting their car-buying process.

- Pre-Approval Options: Some reviews may mention pre-approval options offered by Auto Credit Express. Pre-approvals provide borrowers with an indication of their loan eligibility and potential loan terms before submitting a formal application. This efficiency measure can save borrowers time and effort by allowing them to explore their loan options before committing to a specific loan.

- Online Account Management: Positive reviews may highlight Auto Credit Express's online account management portal. This feature allows borrowers to conveniently track their loan status, make payments, and access important loan-related information online, enhancing the overall efficiency of loan management.

Efficiency in the loan application process and quick loan approvals are essential for a positive customer experience. Auto credit express loan reviews that emphasize efficiency indicate the company's commitment to providing a streamlined and time-saving borrowing experience for its customers.

Read also:Liberty Mutual Auto Insurance Get The Coverage You Need

3. Customer Service

In the context of auto credit express loan reviews, customer service plays a pivotal role in shaping the overall borrowing experience. Responsive and helpful support throughout the loan process can make a significant difference in customer satisfaction and brand loyalty.

- Prompt and Accessible Communication: Positive reviews often highlight Auto Credit Express's prompt response times and accessible communication channels. Customers appreciate being able to reach customer service representatives quickly and easily via phone, email, or online chat, ensuring their queries and concerns are addressed efficiently.

- Knowledgeable and Courteous Staff: Reviews should assess the knowledge and professionalism of Auto Credit Express's customer service staff. Positive reviews indicate that the staff is well-informed about loan products, policies, and procedures and provides courteous and helpful assistance to borrowers throughout the loan process.

- Personalized Support: Some reviews may mention personalized support offered by Auto Credit Express. Customers value the ability to interact with a dedicated loan officer who understands their individual needs and provides tailored guidance and assistance.

- Problem Resolution: Reviews should indicate how Auto Credit Express handles loan-related issues and complaints. Positive reviews highlight the company's responsiveness in addressing customer concerns and finding satisfactory solutions, fostering trust and building long-term customer relationships.

Auto credit express loan reviews that emphasize responsive and helpful customer service indicate the company's commitment to providing borrowers with a positive and supportive borrowing experience. Excellent customer service can help build customer loyalty, increase customer retention, and enhance the overall reputation of Auto Credit Express in the market.

4. Reputation

In the realm of auto credit express loan reviews, reputation serves as a beacon of trust and reliability. Industry standing and customer feedback on platforms like the Better Business Bureau (BBB) play a pivotal role in shaping the overall perception of Auto Credit Express and its services.

Positive reviews on the BBB website, coupled with a high industry standing, indicate customer satisfaction, ethical business practices, and a commitment to resolving any complaints or disputes promptly and efficiently. A strong reputation assures potential borrowers that they are dealing with a reputable lender who values transparency, integrity, and customer-centricity.

Conversely, negative reviews or a low BBB rating can raise red flags and deter potential borrowers from considering Auto Credit Express for their financing needs. Negative feedback may highlight issues with customer service, loan terms, or hidden fees, affecting the company's credibility and trustworthiness.

By carefully considering reputation as a component of auto credit express loan reviews, borrowers can make informed decisions about their financing options. A solid reputation, backed by positive customer feedback and a high industry standing, can instill confidence and provide peace of mind during the loan application and repayment process.

5. Eligibility

In the realm of auto credit express loan reviews, eligibility criteria play a crucial role in shaping the overall borrowing experience. Auto Credit Express offers loan options tailored to borrowers with varying credit profiles, catering to a wide range of financial circumstances.

- No Credit History: Positive reviews often highlight Auto Credit Express's willingness to consider borrowers with limited or no credit history. This aspect is particularly important for first-time borrowers or those rebuilding their credit.

- Bad Credit Scores: Reviews may indicate that Auto Credit Express offers loan options to borrowers with bad credit scores. This inclusivity provides opportunities for individuals with past credit challenges to secure financing for their vehicle purchases.

- Flexible Income Requirements: Some reviews mention Auto Credit Express's flexible income requirements. This flexibility can be beneficial for borrowers with non-traditional income sources or those who may not meet traditional income thresholds.

- Debt-to-Income Ratio: Reviews should assess how Auto Credit Express considers debt-to-income ratio when evaluating loan applications. A reasonable approach to debt-to-income ratio can increase the accessibility of loans for borrowers with other financial obligations.

Auto credit express loan reviews that emphasize eligibility criteria tailored to varying credit profiles indicate the company's commitment to financial inclusion and providing access to financing for a diverse range of borrowers. This inclusivity can significantly impact customer satisfaction and contribute to the company's positive reputation in the lending industry.

6. Loan Terms

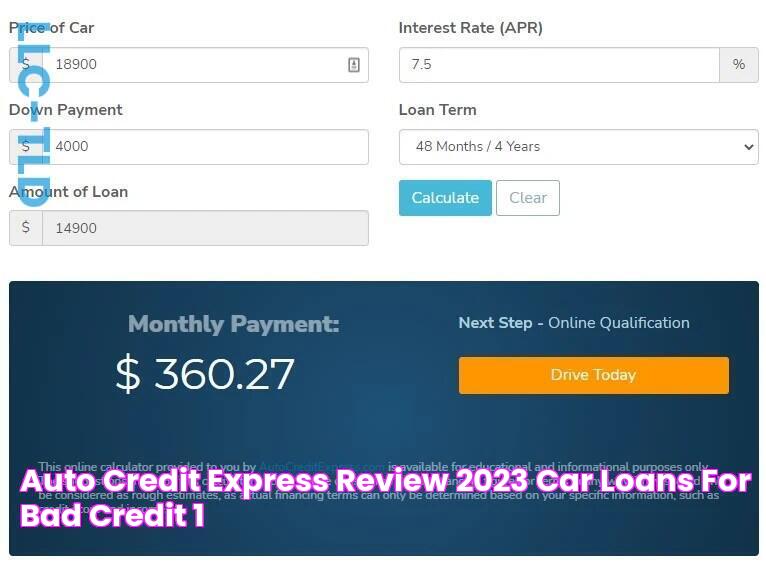

Loan terms play a critical role in shaping the overall borrowing experience and customer satisfaction with auto credit express loan reviews. Flexible loan durations, interest rates, and repayment plans offered by Auto Credit Express cater to the diverse financial needs and situations of borrowers.

- Flexible Loan Durations:

Positive reviews often highlight Auto Credit Express's flexible loan durations. This flexibility allows borrowers to choose loan terms that align with their financial capabilities and repayment preferences. Longer loan durations can result in lower monthly payments but higher total interest costs, while shorter loan durations lead to higher monthly payments but lower overall interest expenses.

- Competitive Interest Rates:

Auto credit express loan reviews should assess the competitiveness of Auto Credit Express's interest rates. Competitive rates can significantly reduce the total cost of borrowing and improve the affordability of auto loans. Reviews may compare interest rates offered by Auto Credit Express with those offered by other lenders to gauge their competitiveness.

- Tailored Repayment Plans:

Positive reviews often mention Auto Credit Express's tailored repayment plans. These plans allow borrowers to customize their monthly payments based on their cash flow and financial situation. Flexible repayment options can reduce the risk of missed payments and improve the overall loan management experience for borrowers.

- Prepayment Options:

Some reviews may highlight Auto Credit Express's prepayment options. The ability to make additional payments or prepay the loan without penalty can save borrowers money on interest and shorten the loan term. Reviews should indicate whether Auto Credit Express allows prepayments and if there are any associated fees or restrictions.

Auto credit express loan reviews that emphasize flexible loan terms, competitive interest rates, and tailored repayment plans indicate the company's commitment to providing borrowers with customized and affordable financing solutions. These factors can significantly impact customer satisfaction and contribute to the company's reputation as a reliable and customer-centric lender.

7. Additional Fees

Additional fees associated with auto loans, such as origination fees or processing fees, play a significant role in shaping auto credit express loan reviews. These fees can impact the overall cost of borrowing and should be carefully considered when evaluating loan options.

Positive auto credit express loan reviews often highlight transparency in disclosing and explaining additional fees. Customers appreciate being fully informed about all costs associated with their loans, avoiding unexpected expenses and building trust with the lender. Negative reviews, on the other hand, may indicate a lack of clarity or excessive fees, which can lead to customer dissatisfaction.

Understanding additional fees is crucial for borrowers to make informed decisions and compare loan offers effectively. By carefully reviewing auto credit express loan reviews, borrowers can assess how the company handles additional fees and make choices that align with their financial goals.

FAQs about Auto Credit Express Loan Reviews

This section addresses frequently asked questions based on auto credit express loan reviews. These questions aim to provide clarity and information to potential borrowers considering Auto Credit Express for their auto financing needs.

Question 1: Are the loan terms and rates offered by Auto Credit Express competitive?

Auto credit express loan reviews often assess the competitiveness of the company's loan terms and rates. Positive reviews indicate that Auto Credit Express offers competitive rates compared to other lenders, helping borrowers secure affordable auto financing.

Question 2: How transparent is Auto Credit Express about additional fees?

Transparency is a key factor highlighted in auto credit express loan reviews. Positive reviews emphasize that the company clearly discloses and explains any additional fees associated with their loans, ensuring that borrowers are fully informed about the total cost of borrowing.

Question 3: What is the customer service experience like at Auto Credit Express?

Auto credit express loan reviews often mention the customer service experience as a crucial aspect. Positive reviews highlight responsive and helpful customer support throughout the loan process, contributing to overall customer satisfaction.

Question 4: How flexible are the loan repayment options offered by Auto Credit Express?

Flexibility in loan repayment options is another common topic in auto credit express loan reviews. Positive reviews indicate that Auto Credit Express offers tailored repayment plans, allowing borrowers to customize their monthly payments based on their financial situation.

Question 5: How does Auto Credit Express handle loan applications with bad credit scores?

Auto credit express loan reviews provide insights into how the company approaches loan applications with bad credit scores. Positive reviews suggest that Auto Credit Express is open to working with borrowers with less-than-perfect credit, offering loan options that cater to their needs.

Question 6: What is the overall reputation of Auto Credit Express based on customer reviews?

Auto credit express loan reviews can provide valuable information about the company's reputation among customers. Positive reviews often highlight the company's commitment to customer satisfaction, ethical lending practices, and a dedication to resolving any issues promptly.

Summary: Understanding auto credit express loan reviews can help potential borrowers make informed decisions about their financing options. Positive reviews consistently emphasize transparency, competitive rates, helpful customer service, flexible repayment plans, inclusivity for borrowers with varying credit profiles, and a commitment to customer satisfaction. By carefully considering auto credit express loan reviews, borrowers can increase their chances of securing affordable and reliable auto financing.

Transition: This section concludes the FAQs about auto credit express loan reviews. For further exploration of the topic, the next section provides additional insights and considerations for potential borrowers.

Tips Based on Auto Credit Express Loan Reviews

By considering auto credit express loan reviews, potential borrowers can gain valuable insights and make informed decisions about their financing options. Here are a few tips to help you navigate the loan process and maximize your chances of a positive borrowing experience:

Tip 1: Research and Compare Lenders:

Before applying for a loan, take the time to research and compare different lenders, including Auto Credit Express. Read loan reviews, check interest rates, and assess the eligibility criteria of various lenders to find the best fit for your financial situation.

Tip 2: Check Your Credit Score:

Your credit score is a crucial factor in determining your loan eligibility and interest rates. Obtain a copy of your credit report and check your score before applying for a loan. If your score is low, consider taking steps to improve it before applying.

Tip 3: Gather Necessary Documents:

To expedite the loan application process, gather all necessary documents, such as proof of income, employment, and identity, before applying. Having these documents organized will streamline the process and increase your chances of a quick loan approval.

Tip 4: Understand Loan Terms:

Carefully read and understand all loan terms, including the loan amount, interest rate, repayment period, and any additional fees. Ensure you are comfortable with the terms before signing the loan agreement.

Tip 5: Explore Repayment Options:

Inquire about different repayment options offered by Auto Credit Express. Choose a repayment plan that aligns with your financial situation and allows you to make timely payments.

Tip 6: Consider Additional Costs:

In addition to the loan amount, factor in any additional costs associated with the loan, such as origination fees or processing fees. Understanding the total cost of borrowing will help you plan your finances accordingly.

Tip 7: Read Customer Reviews:

Customer reviews provide valuable insights into the experiences of others who have borrowed from Auto Credit Express. Read both positive and negative reviews to get a balanced perspective and make an informed decision.

Summary: By following these tips and carefully considering auto credit express loan reviews, you can increase your chances of securing an affordable and suitable auto loan. Remember to research, compare lenders, understand loan terms, and make informed decisions to maximize your borrowing experience.

Transition: This section concludes the tips based on auto credit express loan reviews. For further exploration of the topic, the next section provides additional insights and considerations for potential borrowers.

Conclusion

In conclusion, auto credit express loan reviews provide valuable insights into the experiences of borrowers who have utilized the services of Auto Credit Express. By carefully considering these reviews, potential borrowers can make informed decisions about their financing options and increase their chances of a positive borrowing experience.

Auto credit express loan reviews consistently emphasize the importance of transparency, competitive rates, helpful customer service, flexible repayment plans, and a commitment to customer satisfaction. By choosing a lender that aligns with these values, borrowers can secure affordable and reliable auto financing. It is crucial to research, compare lenders, understand loan terms, and make informed decisions to maximize the borrowing experience.

Revolutionize Rail Yard Management: Unlock Efficiency And Productivity

Tommy Vercetti: The Ruthless And Ambitious Vice City Kingpin

Discover The Journey Of Aniikka Albrite In 2025